Coastal property markets in NSW are on fire — seriously, the growth is off the charts, and it’s all happening in places folks can’t get enough of, like Kiama.

Over at Ridgewaters Kiama, we’re not just sitting by; we’re riding this wave — smartly — positioning our development to grab hold of this surge and offer investors top-notch apartments in what’s arguably one of the South Coast’s hottest spots.

Why Kiama? Well, it’s got the killer combo: close enough to Sydney, stunning nature all around, and booming tourism. It ticks all the boxes for a rock-solid property investment with long-term upsides.

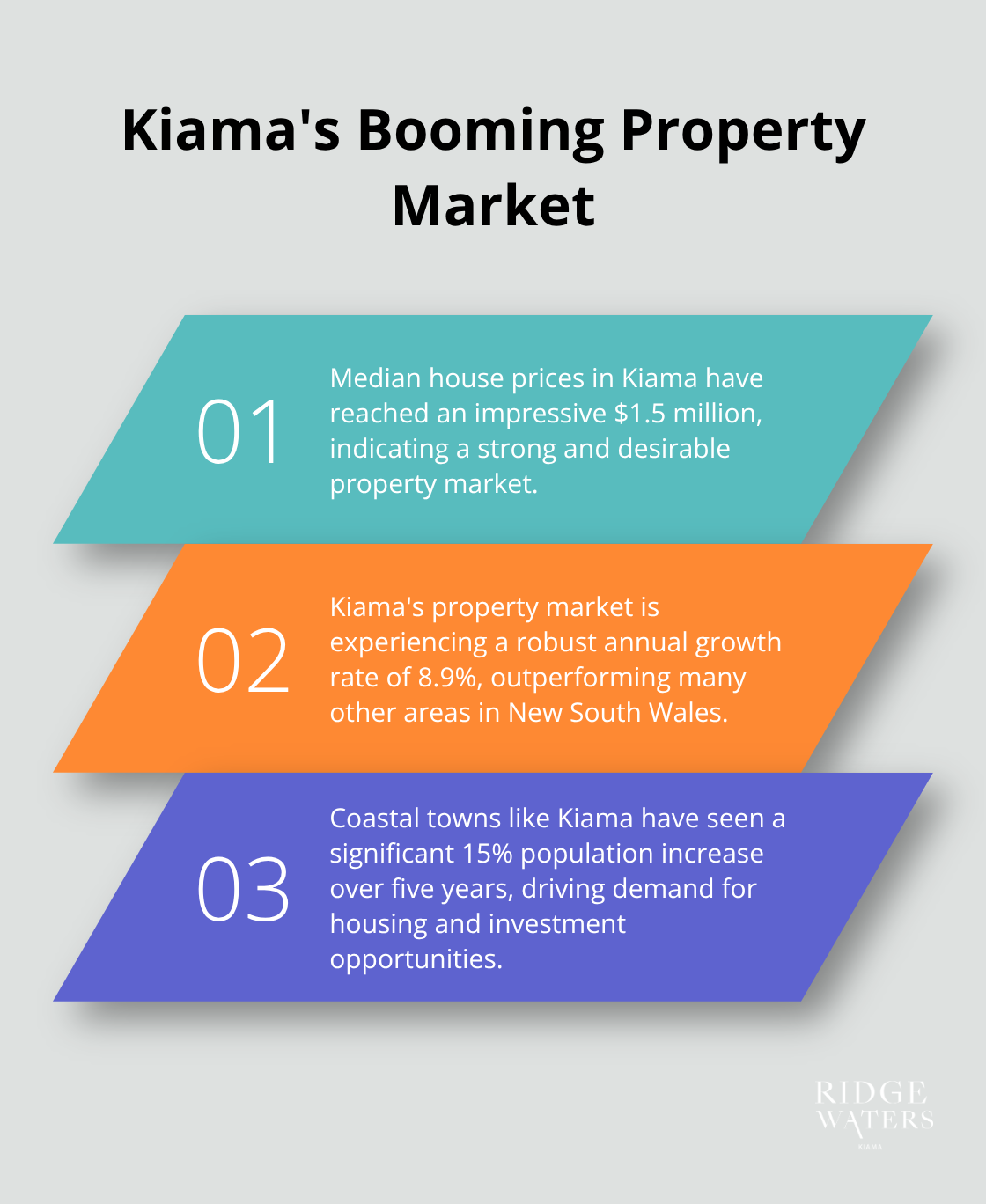

What Makes Kiama’s Property Market So Strong Right Now

Let’s talk turkey – Kiama is on a tear. Median house prices hit $1.5 million…just let that sink in. This lil’ coastal gem is outperforming most of New South Wales. Sydney folks are stampeding in, snapping up homes and cranking demand – it’s like watching a modern gold rush. The Australian Bureau of Statistics? They’re with me – coastal towns rock a 15% population hike over five years, and yeah, Kiama is vibing right at the heart of it.

Sydney Exodus Creates Golden Opportunity

Remote work turned the world upside down. Now, you can ditch the Sydney chaos, settle 90 minutes away, and still crush it at work. This shift? It’s turbocharging property demand like nobody’s business. Check the rental market: less than 1% vacancy and rental prices shooting up 7.4% annually in the Wollongong region (yep, that includes our buddy, Kiama).

And don’t sleep on tourism – over a million visitors flock to Kiama every year. That’s a ripe-for-the-picking short-term rental market for investors itching to cash in on a piece of that vacation pie.

Infrastructure Investment Seals the Deal

NSW Government spent big bucks beefing up transport links between Sydney and towns like Kiama. Translation? Barriers begone. Better connections = beefier property values – dead simple. Government’s got eyes on regional investments, setting the stage that smart investors jump on.

Homes near the good stuff – great amenities and transport – appreciate faster. And Kiama? It’s got these in heaps. CoreLogic spills the beans – coastal property trumps metropolitan zones for capital growth. So, savvy investors, pounce now for those sweet, sweet long-term gains.

This rock-solid market base is ripe for luxury developments that tick the boxes for lifestyle allure and investment magnetism. Today’s buyers? They’re eating it up.

What Makes Ridgewaters Stand Out for Investors

Ridgewaters Kiama is crafting luxury apartments with a twist – these bad boys deliver serious bang for your investment buck. Think contemporary architecture mashed up with those laid-back coastal vibes, creating properties that make premium tenants go, “Yup, take my money.” Oh, and secure parking and private lift access? They’re not just bells and whistles – they’re the secret sauce that elevates these developments above the usual cookie-cutter builds.

Premium Features Drive Higher Returns

Here’s the skinny: smart investors do the math, and it doesn’t lie – luxury finishes equal higher rents. Properties decked out with secure parking in hotspots like Kiama pull in the premium crowd, according to some fresh data on short-term rental markets along Australia’s coast. Private lift access? It’s a win for seniors and families with kiddos (two groups making Kiama’s property demand go through the roof). These aren’t just fancy extras – they’re cash cows that keep vacancy rates so low it’s almost embarrassing, and rental yields nice and plump.

Short-Term Rental Goldmine

Let’s talk numbers – Kiama sees roughly a million tourists a year, turning it into a short-term rental haven. Airbnb properties in coastal New South Wales are raking in $180-220 a night. So yeah, those returns? They demolish the old-school rental game during peak seasons. Luxury apartments are the whole package vacationers crave: security, top-notch amenities, and that picturesque coastal backdrop made for Instagram.

Tourism pops off from December to March, then again around Easter – that’s when savvy investors cash in their chips, fast. With well-placed short-term rentals in Kiama, you’re looking at 30-40% more in annual returns than with your standard leases (especially if you’ve got all the premium goodies and that killer coastal proximity).

Multiple Revenue Streams

What’s the real beauty here? Flexibility, baby. Luxury coastal pads can flip between long-term renters during the slow months and play host to vacationers when things heat up. It’s a strategy that’s all about boosting returns while dodging those pesky vacancy risks. Properties near Kiama’s stunning natural draws and essential amenities? They crush it across the rental spectrum.

These premium perks and prime locations set up investors to tap into Kiama’s strategic edge – a charm that stretches way beyond just the seaside allure.

Why Location Beats Everything in Property Investment

Kiama-just a hop, skip, and jump from Sydney CBD by train-is the goldilocks zone for commuters who want it all: career and lifestyle. This closeness sparked a tidal wave during the remote work boom… Sydney’s pros figured out they could slice costs by 40% and gain that much-desired beach life. CoreLogic tells us homes within a 90-minute radius of big cities score a 15% value boost over those further afield.

Hop on the train-Kiama to Central Station-and you’ve got an hourly promise during peak times. This keeps rental demand solid as a rock from city folks splitting their time between worlds.

Natural Assets Drive Premium Rates

Kiama Blowhole-a showstopper with 400,000 visitors a year-and the coastal walk nudging another 300,000 through its scenic route… This tourism translates into short-term rental gold nuggets. Properties near these hotspots fetch prices 25-30% above the region’s average, according to Airbnb.

In town, you’ve got all the necessities within a 10-minute breath: Woolworths, medical, schools, and coffee spots buzzing all year ’round. This convenience pull is a triforce drawing in retirees escaping Sydney’s grind and families wanting a coastal vibe without losing life’s little luxuries.

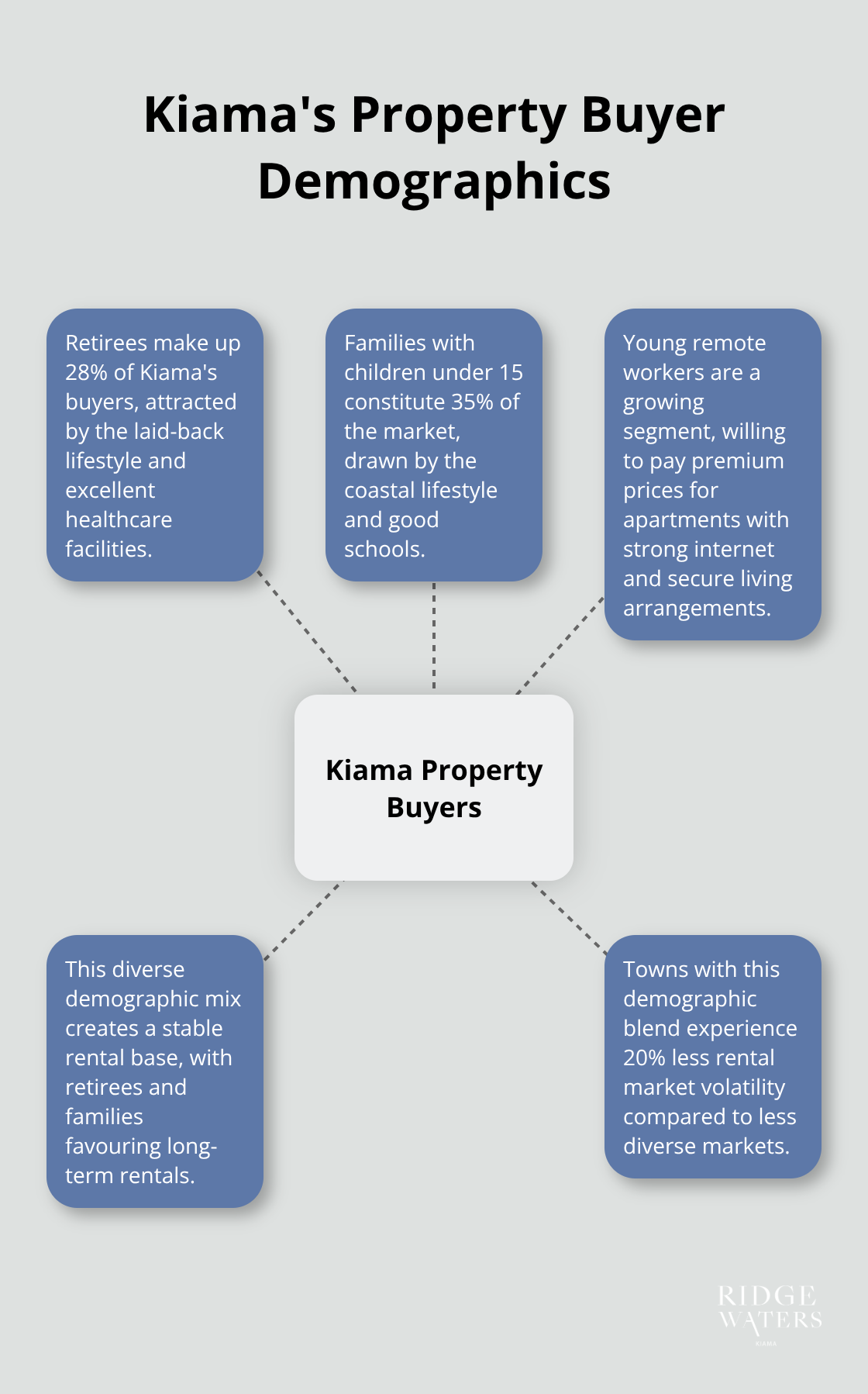

Demographics Create Investment Stability

Retirees-they’re 28% of Kiama’s buyers-love the laid-back tune and the healthcare choirs, while families with kids under 15 form 35% of the market. This blend creates a rental base as solid as granite-retirees favour long-term gigs, families stick for those school zones.

The folks crunching numbers at the Australian Bureau of Statistics say towns with this mix see 20% less rental rollercoaster compared to one-note markets. Young remote workers add another string, happy to drop premium dollars for slick apartments with ironclad internet and secure living (cue Ridgewaters Kiama).

Transport Links Boost Property Values

The NSW Government’s been throwing down hard on transport links between Sydney and gems like Kiama. Faster travel, more trains, boom-direct impact on property fever. Homes near the train lines in coastal NSW, they climb 12% quicker than those adrift from transport ties.

The rock-steady rail system gives investors a chance to aim for both the local scene and Sydney peeps hungry for flexibility. This two-birds-one-stone strategy slices vacancy risks and keeps the rental cashflow humming along through any economic storm.

Final Thoughts

Alright, folks-Ridgewaters Kiama is laying down the gauntlet in Australia’s coastal property frenzy. We’re talking Kiama’s median house prices sky-high at $1.5 million, riding an 8.9% annual growth wave. Buckle up, because this market isn’t slowing down. Ridgewaters Kiama? We’ve rolled out luxury apartments that milk every last bit of value from this prime real estate.

Investment-wise, we’re talking bedrock stability. Think about it: over a million tourists roll in each year, firing up short-term rentals by 30-40% in peak seasons. Sweet little gravy train. Meanwhile, a smooth 90-minute train ride to Sydney means steady long-term rentals from commuters and more flex workers than you can shake a stick at. Coastal properties in NSW? They’re leaving metro areas in the dust when it comes to property value growth (ask CoreLogic).

Throw in our sleek architecture, secure parking, and private lift access, and you’ve got premium tenants swarming in from every corner. And let’s not overlook the NSW Government pumping big bucks into infrastructure-transport links are tightening up and property values along rail lines are jumping 12%. With Kiama’s natural wonders and must-have amenities, Ridgewaters Kiama is serving up a rare blend of lifestyle perks and robust financial returns. This, my friends, is the gold standard of Australia’s coastal investments.