Self-Managed Super Funds (SMSFs) offer a unique opportunity for Australians to take control of their retirement savings. At Ridgewaters Kiama, we’ve seen growing interest in using a self-managed super fund to buy property.

This comprehensive guide will walk you through the essentials of SMSF property investment, from understanding the basics to implementing successful strategies. We’ll explore the advantages, responsibilities, and key considerations to help you make informed decisions about your financial future.

What Are Self-Managed Super Funds?

Self-Managed Super Funds (SMSFs) empower Australians to take control of their retirement savings. Unlike traditional super funds, SMSFs allow members to manage their own investments, including property. This structure offers greater flexibility and investment choices, making it an attractive option for many.

The Nuts and Bolts of SMSFs

SMSFs can include up to four members, all of whom must serve as trustees or directors of the corporate trustee. The Australian Taxation Office (ATO) reports that as of December 2024, approximately 600,000 SMSFs existed in Australia, managing over $970 billion in assets. This represents a significant portion (about 23%) of the country’s $4.1 trillion superannuation industry.

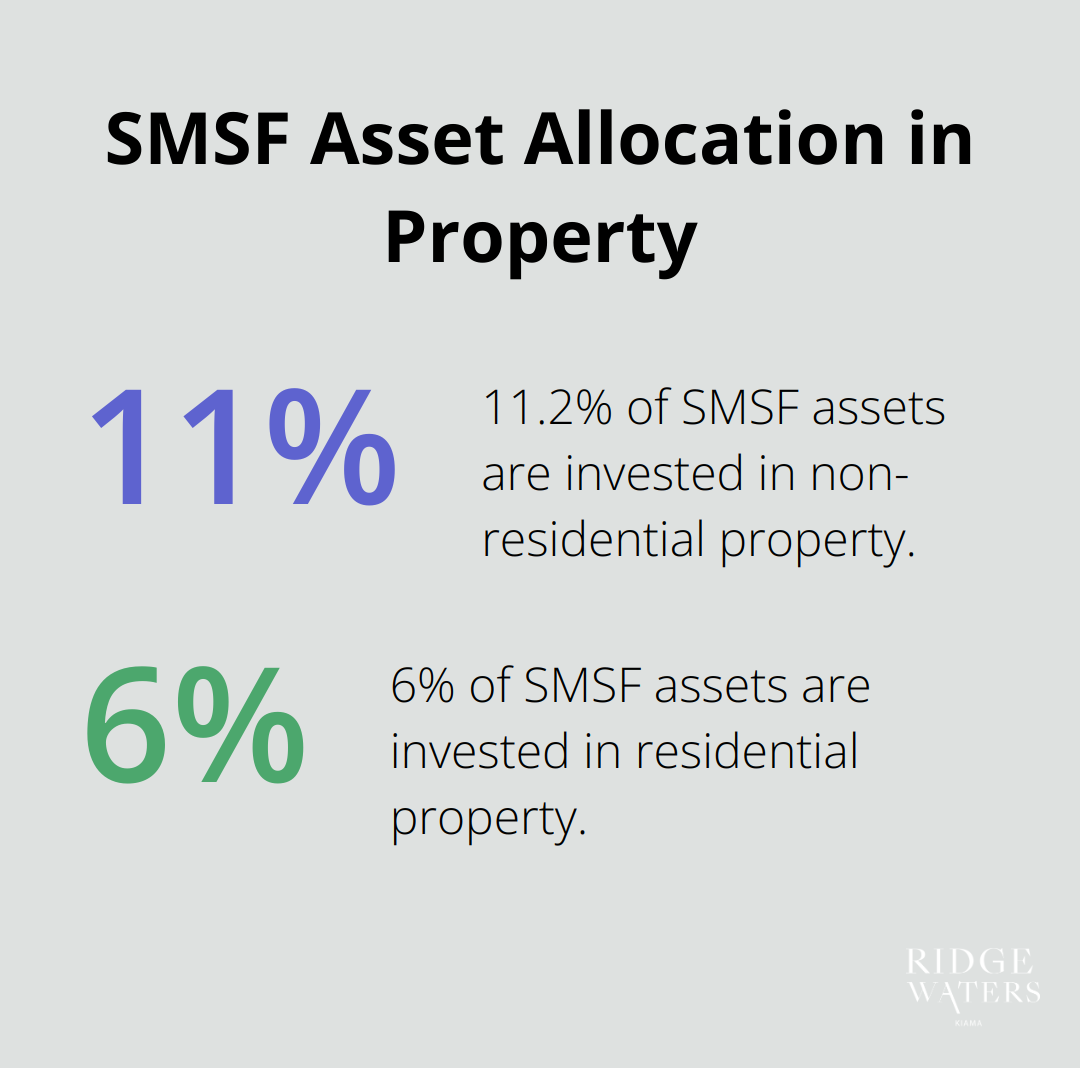

One of the main advantages of SMSFs for property investment is the ability to purchase both residential and commercial real estate. The ATO indicates that about 19% of SMSF assets are invested in property (11.2% in non-residential and 6% in residential property). This translates to roughly $168 billion invested in real estate through SMSFs.

Property Investment Perks with SMSFs

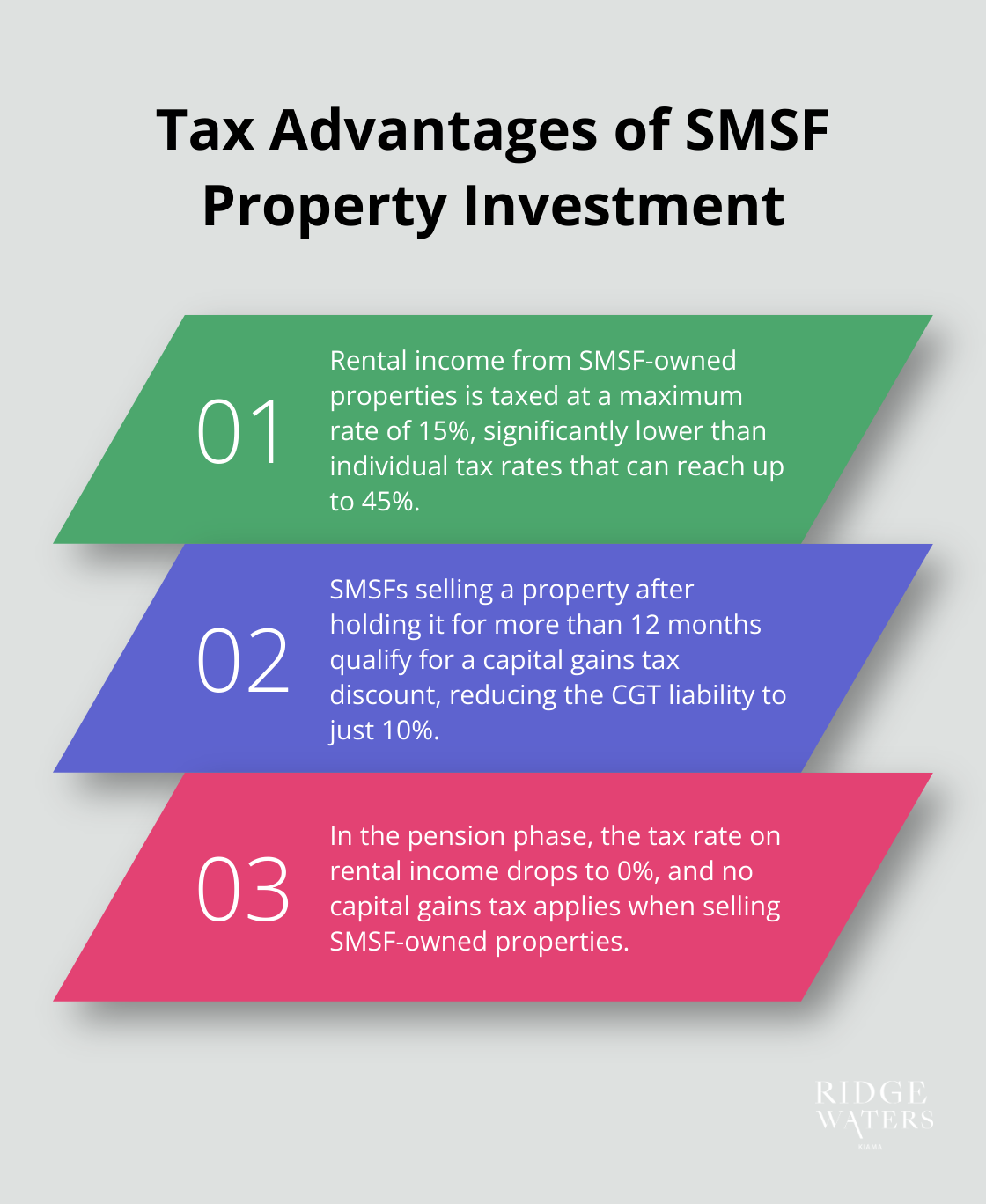

SMSFs offer unique benefits for property investors. For example, rental income from SMSF-owned properties is taxed at a maximum rate of 15% (significantly lower than individual tax rates that can reach up to 45%). Additionally, if an SMSF sells a property after holding it for more than 12 months, it qualities for a capital gains tax discount, reducing the CGT liability to just 10%.

In Kiama, the potential for both capital growth and rental income is particularly attractive. The coastal location and growing popularity as a vacation destination make it an ideal spot for SMSF property investment.

Trustee Responsibilities and Legal Obligations

While SMSFs offer greater control, they also come with significant responsibilities. Trustees must ensure their fund complies with superannuation laws and the fund’s trust deed. This includes:

- Developing and implementing an investment strategy

- Maintaining accurate records

- Arranging annual audits

The ATO strictly enforces these obligations. In the 2023-2024 financial year, the ATO conducted over 15,000 SMSF audits, resulting in penalties for non-compliance in about 2% of cases. To avoid such issues, trustees should stay informed about SMSF regulations and seek professional advice when needed.

Kiama: A Prime Location for SMSF Property Investment

For those considering SMSF property investment in Kiama, understanding these responsibilities is essential. The local market dynamics (coupled with the legal obligations of SMSF trustees) require careful consideration and planning.

Kiama offers a unique blend of coastal charm and investment potential. With its pristine beaches, historic lighthouse, and famous blowhole, the town attracts tourists year-round. This consistent demand for short-term accommodations can provide steady rental income for SMSF property investors.

Moreover, Kiama’s proximity to Sydney (just 90 minutes south) makes it an attractive option for both weekenders and those looking for a sea change. This dual appeal can potentially lead to strong capital growth over time.

As we move forward, let’s explore the specific types of properties eligible for SMSF investment and the rules governing these investments in Kiama and beyond.

SMSF Property Investment in Kiama

Eligible Properties in Kiama’s Market

SMSFs can invest in a variety of properties in Kiama. Residential options include apartments, houses, and townhouses. Commercial properties encompass retail spaces, offices, and industrial units.

Kiama’s real estate market offers diverse opportunities. A beachfront apartment could serve as a lucrative short-term rental. Alternatively, a commercial property in Kiama’s town centre might provide steady long-term income.

Strict Regulations for SMSF Property Investment

When investing in Kiama property through your SMSF, you must follow strict regulations. The property must serve the sole purpose of providing retirement benefits. This rule prohibits you or your relatives from living in or using the property.

For Kiama’s holiday rentals, this rule works in your favour. While you can’t stay in the property yourself, you can rent it out to tourists (potentially generating significant income during peak seasons).

Financing Options for Kiama Properties

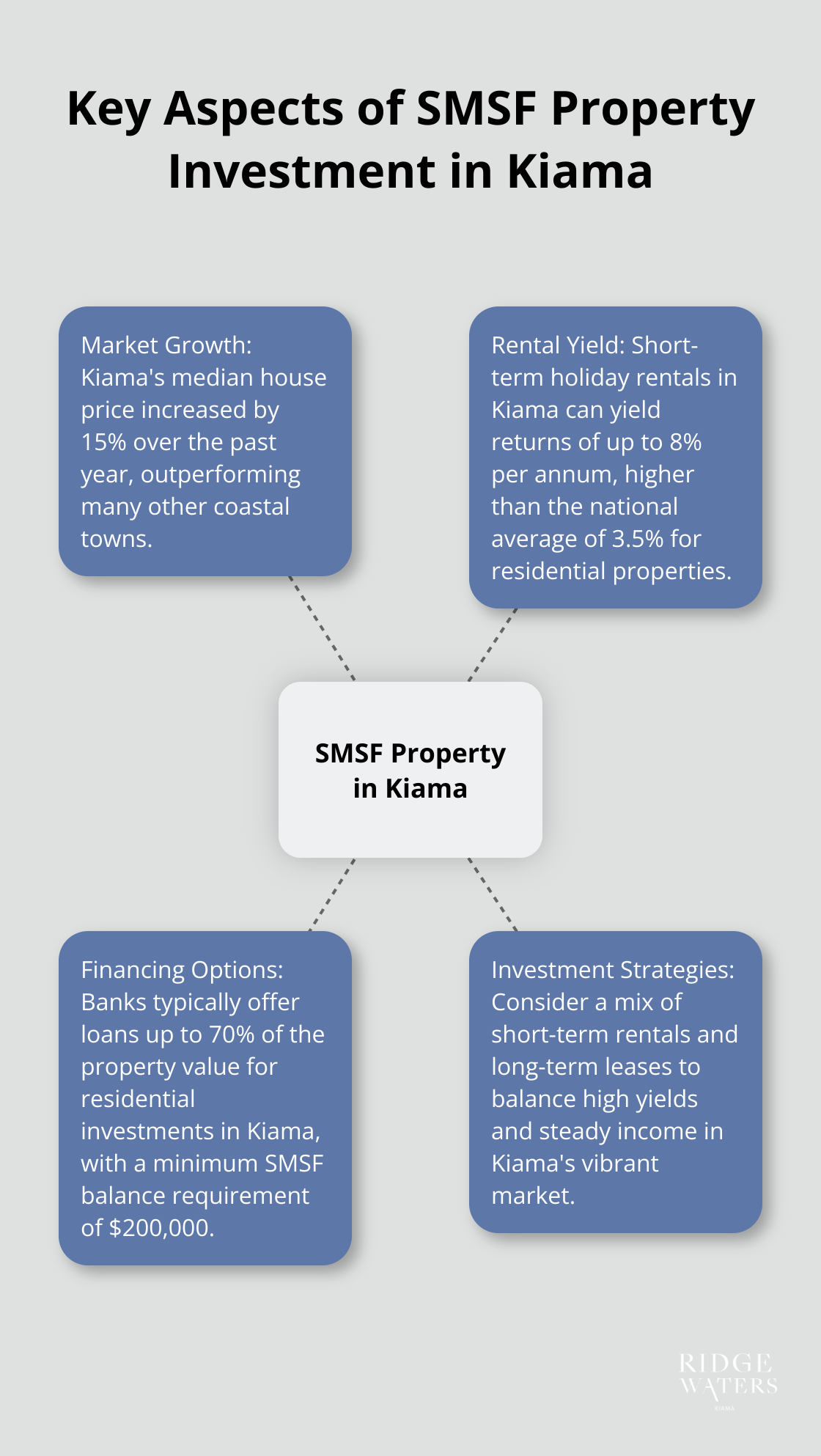

SMSFs can borrow to purchase property through a Limited Recourse Borrowing Arrangement (LRBA). Most lenders require a minimum SMSF balance of $200,000 for property investment in areas like Kiama.

Typically, banks offer loans up to 70% of the property value for residential investments in Kiama. For commercial properties, this percentage might drop to 60-65%.

Your SMSF must maintain sufficient liquidity to cover loan repayments, property management fees, and other expenses. In Kiama’s market, a well-chosen property should generate enough rental income to cover these costs.

Kiama’s Unique Market Dynamics

Kiama’s property market has shown steady growth. Local real estate data indicates that Kiama’s median house price increased by 15% over the past year, outperforming many other coastal towns.

For SMSF investors, this growth potential (combined with Kiama’s strong rental market) presents an attractive proposition. Short-term holiday rentals in Kiama can yield returns of up to 8% per annum (significantly higher than the national average of 3.5% for residential properties).

Investment Strategies for Kiama’s SMSF Properties

When considering SMSF property investment in Kiama, you should develop a clear strategy. This strategy should align with your fund’s investment goals and risk tolerance. You might focus on capital growth by targeting properties in up-and-coming areas of Kiama. Alternatively, you could prioritise rental yield by investing in properties with high demand among holiday-makers.

The next chapter will explore strategies for successful SMSF property investment, including diversification, tax considerations, and long-term planning. These insights will help you maximise the potential of your SMSF property investment in Kiama’s vibrant market.

Strategies for Successful SMSF Property Investment in Kiama

Diversification in Kiama’s Property Market

SMSF investors should consider multiple property types in Kiama to spread risk. The town offers various options, from beachfront apartments to commercial spaces in the town centre. Local real estate data shows Kiama’s median house price increased by 15% last year, but past performance doesn’t guarantee future results. A mix of short-term rentals and long-term leases can provide a balance of high yields and steady income.

Tax Benefits for SMSF Property Investors

SMSF property investments in Kiama come with significant tax advantages. In the 2023/24 financial year, LGP returned a gross surplus (before allocation of rebates) of $3.82 million – a 5% increase on the previous year. Rental income is taxed at a maximum rate of 15% (compared to individual rates of up to 45%). In the pension phase, this rate drops to 0%. Capital gains tax (CGT) benefits are also substantial. SMSFs pay CGT on only two-thirds of the capital gain when selling a property held for over 12 months. In the pension phase, no CGT applies.

Long-Term Planning for Kiama Investments

SMSF property investment in Kiama should align with long-term retirement goals. The town’s popularity as a holiday destination suggests potential for capital growth and rental income. However, investors must factor in ongoing costs (property management fees, maintenance, vacancy periods). A 10-year cash flow project can include expected rental income, expenses, and loan repayments (if applicable).

Maximizing Returns in Kiama’s Holiday Market

Kiama’s strong tourism sector offers opportunities for high rental yields. Local property managers report that well-maintained properties in prime locations can achieve occupancy rates of up to 80% during peak seasons. Short-term holiday rentals in Kiama can yield returns of up to 8% per annum (higher than the national average of 3.5% for residential properties).

Navigating SMSF Regulations in Property Investment

SMSF trustees must adhere to strict regulations when investing in Kiama property. The property must serve the sole purpose of providing retirement benefits. This rule prohibits trustees or their relatives from living in or using the property. For Kiama’s holiday rentals, this rule can work in investors’ favour, allowing them to tap into the lucrative short-term rental market without personal use restrictions.

Final Thoughts

SMSF property investment in Kiama offers a compelling opportunity for Australians who want to secure their financial future. The use of a self-managed super fund to buy property provides unparalleled control over retirement savings, coupled with significant tax advantages. Rental income taxed at a maximum of 15% and potential CGT discounts make SMSF property investment an attractive option for savvy investors.

The benefits of SMSF property investment come with substantial responsibilities. Trustees must follow complex regulations, maintain meticulous records, and ensure compliance with superannuation laws. The engagement of qualified financial advisers, accountants, and legal professionals will help avoid costly mistakes and maximise the potential of your SMSF property investment.

For those who consider SMSF property investment in Kiama, Ridgewaters Kiama presents an excellent opportunity. With its luxury apartments, contemporary architecture, and prime location, Ridgewaters Kiama offers the perfect blend of lifestyle and investment potential (suitable for both permanent residence and short-term rental). Thorough research, careful planning, and ongoing management will lead to success in SMSF property investment.