If you own a coastal vacation rental and you’re still running on fixed pricing — you’re literally leaving cash on the sand. At Ridgewaters Kiama, we’ve seen owners lift revenue 20–40% — not by luck, not by luck (seriously) — but by simply nudging rates to follow demand patterns.

Airbnb pricing tools and other platforms have democratised what used to be the realm of hotel revenue managers… dynamic pricing is now an app on your phone. This guide shows you exactly how to implement these strategies for your apartment — actionable, no-fluff, and probably profitable.

How Dynamic Pricing Responds to Coastal NSW Demand Patterns

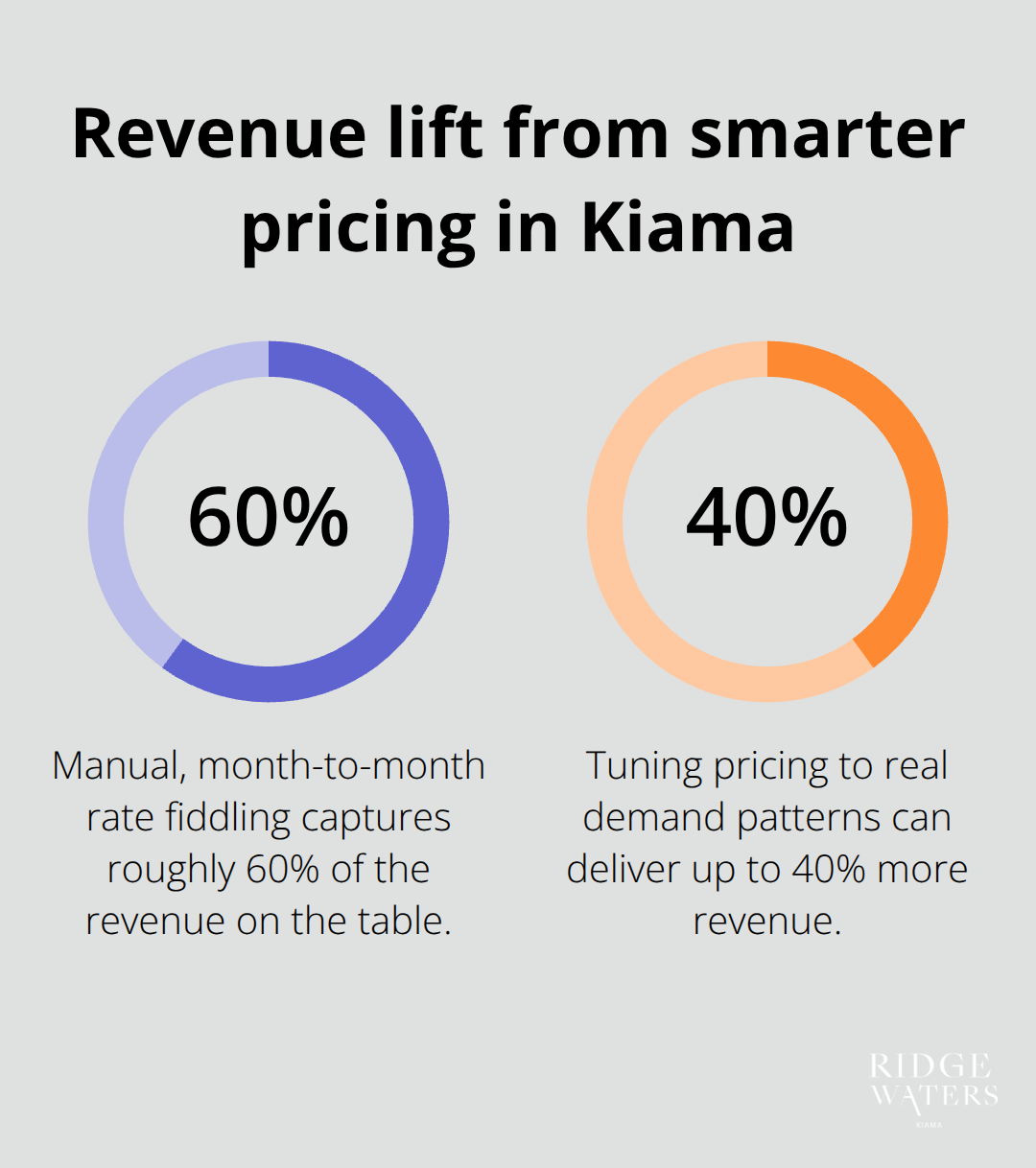

Dynamic pricing isn’t some academic exercise – it’s a direct reaction to how people actually book coastal places. In Kiama demand is anything but flat. School holidays in April, July, and December spike occupancy; March and September slide into softer booking moments. Owners who fiddle with rates month-to-month by hand capture maybe 60% of the revenue on the table – owners who tune pricing to demand patterns routinely pocket up to 40% more.

The mechanism is boringly simple: when Airbnb or Booking.com lights up with searches for your dates, you push rates up. When searches cool, you pull them down to fill the gaps. Not guesswork – matching supply to real market signals. Kiama sits 90 minutes south of Sydney – a natural weekend escape during school breaks and summer – so those demand spikes are predictable and profitable if you price like you know they’re coming.

Peak Seasons Drive Disproportionate Revenue

Australian school holidays give you four booking windows a year – and they’re not equal. July (winter) and December–January (summer) are the heavy hitters: occupancy in Kiama often hits 85–95% in those stretches. Easter in April moves the needle too, just not quite as hard. Owners who keep a fixed price leave 30–50% of potential revenue on the table. Example: a place charging $120 in March could easily command $200–250 a night in July – bookings won’t vanish; the demand is there. The competitive set in Kiama proves it – operators run rates that swing 50–100% between off-peak and peak. Summer weekends (Dec–Feb) scream family bookings; school-holiday weeks pull families and groups with different price sensitivity. The smart owners nudge rates 4–6 weeks before the rush and lock in early planners at premium prices – get visibility, get paid.

Off-Peak Periods Require Volume Over Margin

Flip the script for slow months. March, September, October usually sit at 40–60% occupancy – and empty nights are the real cost. Dropping rates 20–30% in those periods often attracts bookings that more than cover the lower nightly take. A property vacant five nights a month at $150 yields nothing from those nights; drop to $110 and fill three of them – you get $330 instead of zero. That’s not undercutting – that’s revenue optimisation. Data shows coastal NSW properties that lean into aggressive off-peak pricing hit 70–75% annual occupancy; static pricers average 55–60%. That occupancy gap translates to about 25–35% more annual revenue. And remember – Kiama’s weekend appeal means off-peak weekends still beat weekdays, so price by day-of-week as well as season.

Timing Your Rate Adjustments for Maximum Impact

Successful owners don’t wait for the calendar to scream “holiday” – they move early. Setting rates 30–45 days before a big school break gets you into early search results at competitive prices and captures planners who book ahead.

Platforms like Airbnb and Booking.com favour listings with steady availability and competitive pricing in their algorithms – so strategic price moves buy you visibility. Mid-week nights in Kiama run roughly 30–40% lower than weekends year-round, so your calendar should reflect that every season. Test rate tweaks on a two-week cycle during shoulders (April–May, Sep–Oct) to find the sweet spots that maximise occupancy and revenue – without guessing.

Building Your Pricing Foundation in Kiama

Know Your Market Before You Set Rates

Start with what the market will actually bear in Kiama – not the price you’d like to charge in a perfect world. Pull rate data from Airbnb and Booking.com for comparable properties nearby (filter by apartment size, amenities, and distance to the beach). Most coastal NSW properties at this level – contemporary, secure, lift access – anchor between $140–$180 in shoulder seasons and $220–$280 during peak weeks. Your baseline should live in that band unless your unit has a real edge – a water view, a prime spot, something that makes guests pay for the bragging rights.

Test your starting rate for two weeks in a neutral month like May or October, then watch the inquiry-to-booking funnel. Zero inquiries? You’re priced too high. Everything books instantly? You’re leaving cash on the table – welcome to “conservative pricing” that becomes passive revenue sabotage.

Airbnb’s pricing tool will spit out suggested rates based on local demand – use it as a sanity check, not scripture. The objective: know where you sit relative to the crowd so your moves feel deliberate – data-led – not panicked or reactive.

Capitalise on School Holiday Spikes

School holidays in Kiama are not subtle. Families flee Sydney for beach time – occupancy ticks up to 85–95% across the region. Your baseline needs to jump 50–80% for those weeks – a property at $160 in June should be $240–$290 in July. December into early January is even more aggressive – holidays plus summer demand plus weekend premiums equals pricing that should make you uncomfortable (in a good way). Lock those weeks in 6–8 weeks ahead to capture the planners who book family trips in September.

Easter deserves a 30–40% bump for the week itself – but don’t spread that increase across March and May; those months stay soft. Platforms automate much of this now, so use their calendar tools to set peak-season rates months out and stop leaving money on the table.

Layer Weekend Premiums Year-Round

Both Airbnb and Booking.com let you adjust rates by specific dates or ranges without rewriting your calendar – which means you can stack seasonal increases on top of weekend premiums in seconds. A $200 base rate becomes $220 Friday–Sunday even in off-peak months – Kiama’s 90-minute proximity to Sydney makes weekends profitable year-round. This dual-layer approach – seasonal shifts plus weekend premiums – captures the macro demand curve and the micro booking behaviours that drive revenue.

Strategic, data-driven pricing tactics Strategic, data-driven pricing tactics attract guests, cover fixed costs, and preserve long-term profitability for your rental.

Tools and Platforms That Maximise Revenue

Airbnb and Booking.com Built-In Pricing Features

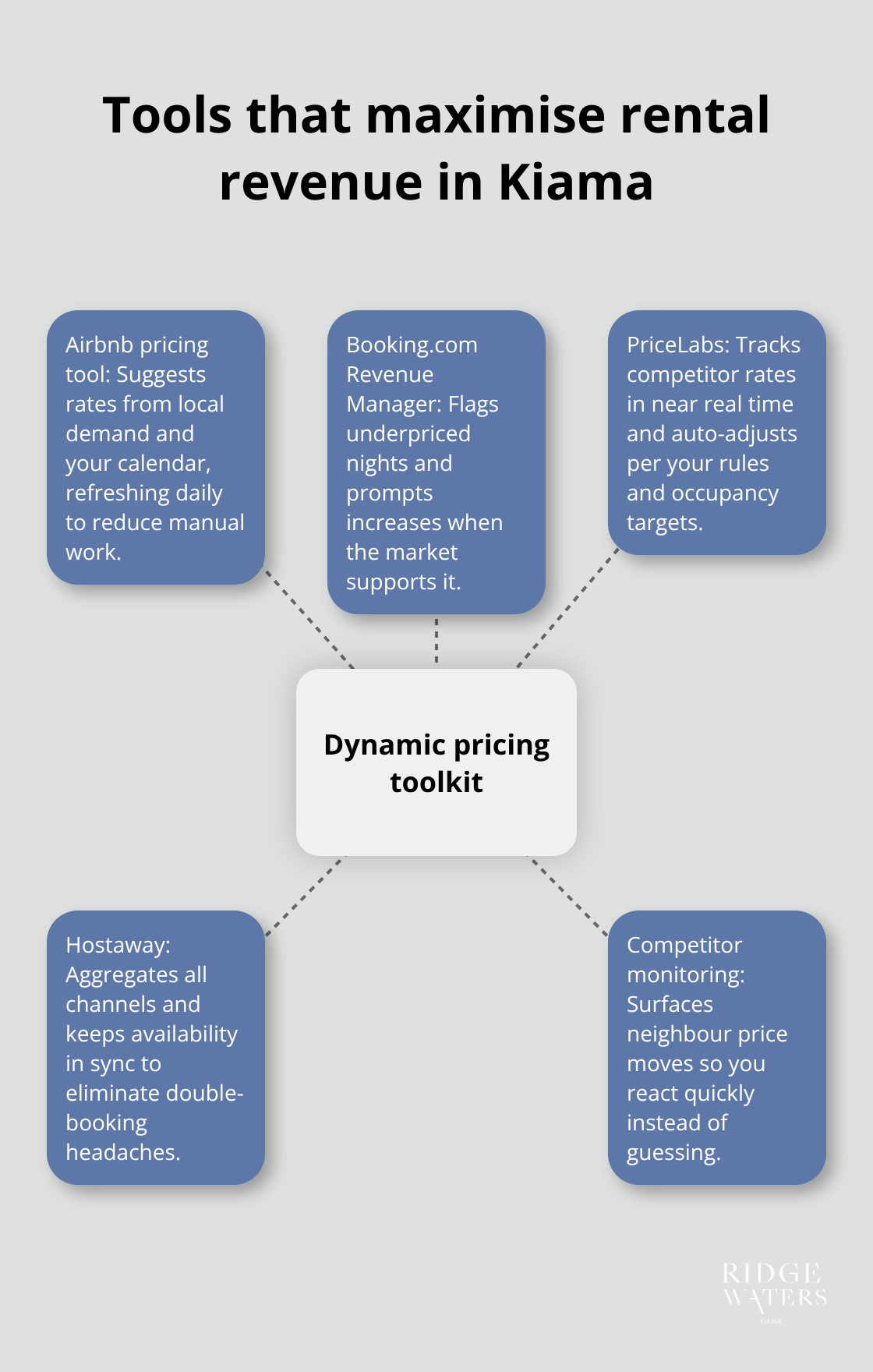

Airbnb’s pricing tool is the quickest path from “listed” to “booked” – it’s basically training wheels for revenue.

It suggests rates by reading local demand and your calendar, refreshing daily so you don’t have to babysit spreadsheets. The system watches search volume, booking velocity, and competitor pricing in Kiama and then whispers (or shouts) adjustments; owners who follow its guidance-within about a 10–15% band-generally keep occupancy steady or even nudge it up. Booking.com plays the same game with its Revenue Manager – flags underpriced nights and nudges you to bump rates when the market supports it.

Both plug straight into your calendar, so rate moves propagate across channels instantly – no double-booking drama, no late-night spreadsheet edits. The beauty here is simplicity: if your rental lives mainly on one or two platforms, you can be hands-off and sleep. The downside? These tools crave history. If you’ve only been live a few weeks, you’ll get generic suggestions that miss the quirky local rhythms of Kiama.

Dedicated Revenue Management Software

If you want to stop leaving money on the table, you graduate to dedicated tools – PriceLabs and Hostaway are the common-sense next step. PriceLabs stalks competitor rates across Airbnb and Booking.com in near-real time and auto-adjusts prices per rules you choose – occupancy targets, minimum stays, seasonal caps. Hostaway is the aggregator – it ties all channels together (Airbnb, Booking.com, VRBO, your own site) and keeps availability in sync so you don’t wrestle with updates.

Cost? Think $15–$50 a month depending on how ambitious you are. That’s pocket change if static pricing is bleeding revenue – the software often pays for itself in weeks. Property managers who embrace these tools (and, crucially, the data) can optimise their dynamic pricing strategies, stay ahead of market moves, and focus energy where it matters most – guest experience.

Competitor Rate Monitoring in Real Time

This is where the ROI lives – competitor monitoring turns guesswork into a system. PriceLabs, for example, watches 20–50 comparable listings daily and tells you when neighbours cut or hike prices, so you react rather than guess. Doing this by hand? Expect 5–10 hours a month of clicking calendars and still missing mid-week shifts; software does it in seconds.

For Kiama investors with multiple listings or high-occupancy units, that automation is margin accretion-less friction, more yield. And the advantage compounds: over time you begin to see patterns – how competitors behave around school holidays, long weekends, and seasonality unique to the area – and that insight is pure profit.

Final Thoughts

Dynamic pricing isn’t a nice-to-have for big hotel brands anymore – it’s table stakes. At Ridgewaters Kiama, we’ve watched owners stop guessing and start matching rates to real demand patterns. The result? Properties that move with the market – seasonally, by day-of-week – outperform static-rate neighbours by 25–35% a year. And that advantage compounds fast (like compound interest, but less boring).

How you do it is not mystical: use Airbnb’s pricing tools or a specialist like PriceLabs to stalk local competition and automate changes. Crank rates 50–80% during school holidays and summer – yes, that steep – and shave 20–30% in the soft months to fill empty nights. Add weekend premiums year-round – Kiama’s a weekend magnet for Sydneysiders, so weekends stay profitable even in March and September. Start tuning prices 30–45 days before big demand spikes to catch early planners and to nudge platform algorithms in your favour.

If you own (or are eyeing) an apartment at Ridgewaters Kiama, you’re sitting on a location that pulls families and holidaymakers all year. That demand is your asset – monetise it. Implement dynamic pricing now, watch results for two to three months, then iterate based on market feedback. Small moves, big lift.