At Ridgewaters Kiama, we’ve seen many homeowners unlock the potential of their property’s value. Using equity to buy investment property is a powerful strategy for building wealth.

This approach allows you to leverage your existing assets to expand your real estate portfolio. In this post, we’ll guide you through the process of tapping into your home equity for property investments.

What Is Home Equity and How Can It Boost Your Property Portfolio?

Understanding Home Equity

Home equity represents the difference between your property’s current market value and the outstanding balance on your mortgage. This financial asset can serve as a powerful tool for expanding your property portfolio, especially in thriving markets like Kiama.

The Growth of Equity Over Time

Your home equity increases through two primary mechanisms:

- Mortgage Payments: Each payment reduces your loan balance, thereby increasing your equity.

- Property Appreciation: Kiama’s real estate market has shown significant growth.

How to Calculate Your Available Equity

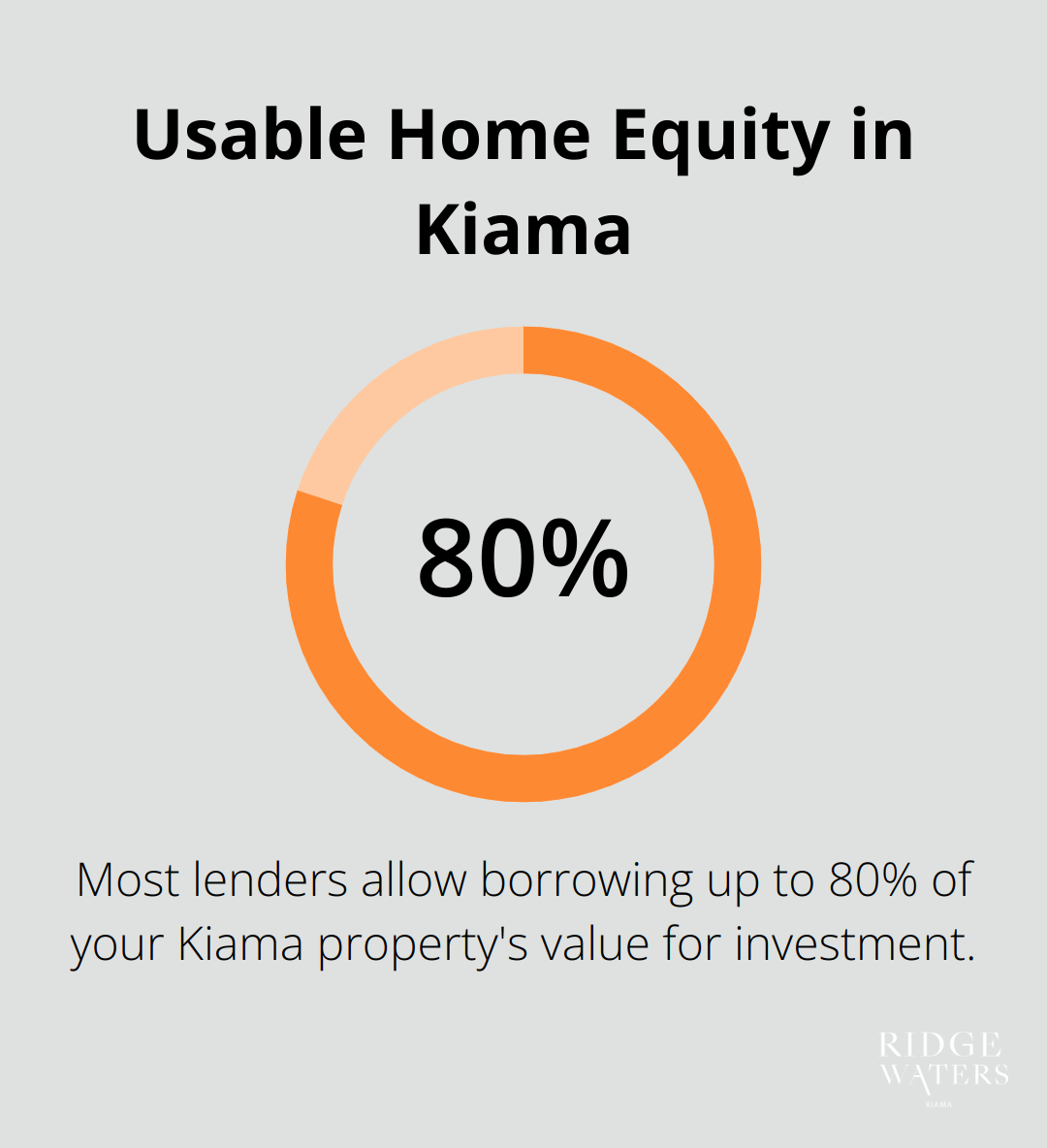

Most lenders allow borrowing up to 80% of your home’s value minus your remaining mortgage balance. Here’s a practical example:

If your Kiama property is valued at $1 million with a $600,000 mortgage remaining, your usable equity would be $200,000. (80% of $1 million = $800,000, minus $600,000)

Investing with Home Equity

Using your home equity to invest in additional properties can accelerate your wealth-building strategy. Kiama’s real estate market offers compelling opportunities due to:

- Rising property values

- Strong rental demand

Financial Benefits of Property Investment

Investing in property using your home equity can offer several financial advantages:

- Tax Benefits: Interest on loans for investment properties is typically tax-deductible, potentially reducing your overall tax liability.

- Rental Income: This income can help offset your investment costs.

Risk Considerations

While using equity for investment can yield significant returns, it’s important to consider potential risks:

- Property value fluctuations

- Interest rate changes

- Market shifts

We recommend maintaining a financial buffer and conducting thorough research on the Kiama property market before making investment decisions. Consulting with a financial adviser can provide valuable insights and help you navigate these considerations effectively.

As you explore the potential of using your home equity for property investment, the next step involves understanding the various methods to access this equity. Let’s examine these options in detail.

How to Access Your Home Equity in Kiama

Home Equity Loans: A Fixed-Rate Solution

Home equity loans, often called second mortgages, allow you to borrow a lump sum against your property’s equity. In Kiama’s property market, these loans typically offer fixed interest rates, which can provide predictable repayments.

For example, if your Kiama property is valued at $800,000 and you have $300,000 remaining on your mortgage, you might be able to borrow up to $340,000 (80% of $800,000 minus $300,000). This could provide substantial capital for an investment property in the area.

Home Equity Lines of Credit (HELOCs): Flexible Borrowing Options

HELOCs function similarly to credit cards, allowing you to draw funds as needed up to a predetermined limit. This flexibility can be particularly useful for Kiama property investors who may need to access funds for renovations or unexpected expenses.

With a HELOC, you only pay interest on the amount you use. This can be cost-effective if you plan gradual property improvements or if you’re unsure about the total amount you’ll need for your investment.

Cash-Out Refinancing: Replacing Your Existing Mortgage

Cash-out refinancing involves replacing your current mortgage with a new, larger loan and pocketing the difference. This option can be attractive if current interest rates are lower than your existing mortgage rate.

In Kiama’s property market, where home values have appreciated significantly, cash-out refinancing could provide substantial funds for investment. For instance, if your home has increased in value from $600,000 to $900,000, you could potentially refinance to a $720,000 loan (80% of the new value) and use the extra funds for an investment property.

Comparing Your Options

When considering these options, it’s important to factor in Kiama’s specific market conditions. The area’s strong rental demand and rising property values make it an attractive location for property investment. However, each method of accessing equity comes with its own set of pros and cons.

Home equity loans offer stability but less flexibility. HELOCs provide more flexibility but often come with variable interest rates. Cash-out refinancing can offer lower interest rates but may extend your loan term.

Making an Informed Decision

Before deciding, we recommend consulting with a local financial adviser who understands Kiama’s property market. They can help you assess which option aligns best with your investment goals and financial situation.

Accessing your home equity can be a powerful tool for building wealth through property investment, but it requires a clear strategy. Consider factors such as potential rental income, property management costs, and long-term market trends in Kiama when planning your investment.

Now that you understand the various methods to access your home equity, let’s explore the specific steps you can take to use this equity for purchasing an investment property in Kiama.

How to Turn Your Kiama Home Equity into an Investment Property

Assess Your Available Equity

Start with a professional valuation of your Kiama property. Local real estate agents or licensed valuers will provide an accurate assessment. Subtract your outstanding mortgage balance from this figure. Most lenders allow borrowing up to 80% of your property’s value. For example, if your Kiama home is valued at $1.2 million with a $600,000 mortgage, your usable equity could reach $360,000 (80% of $1.2 million, minus $600,000).

Identify Prime Investment Opportunities in Kiama

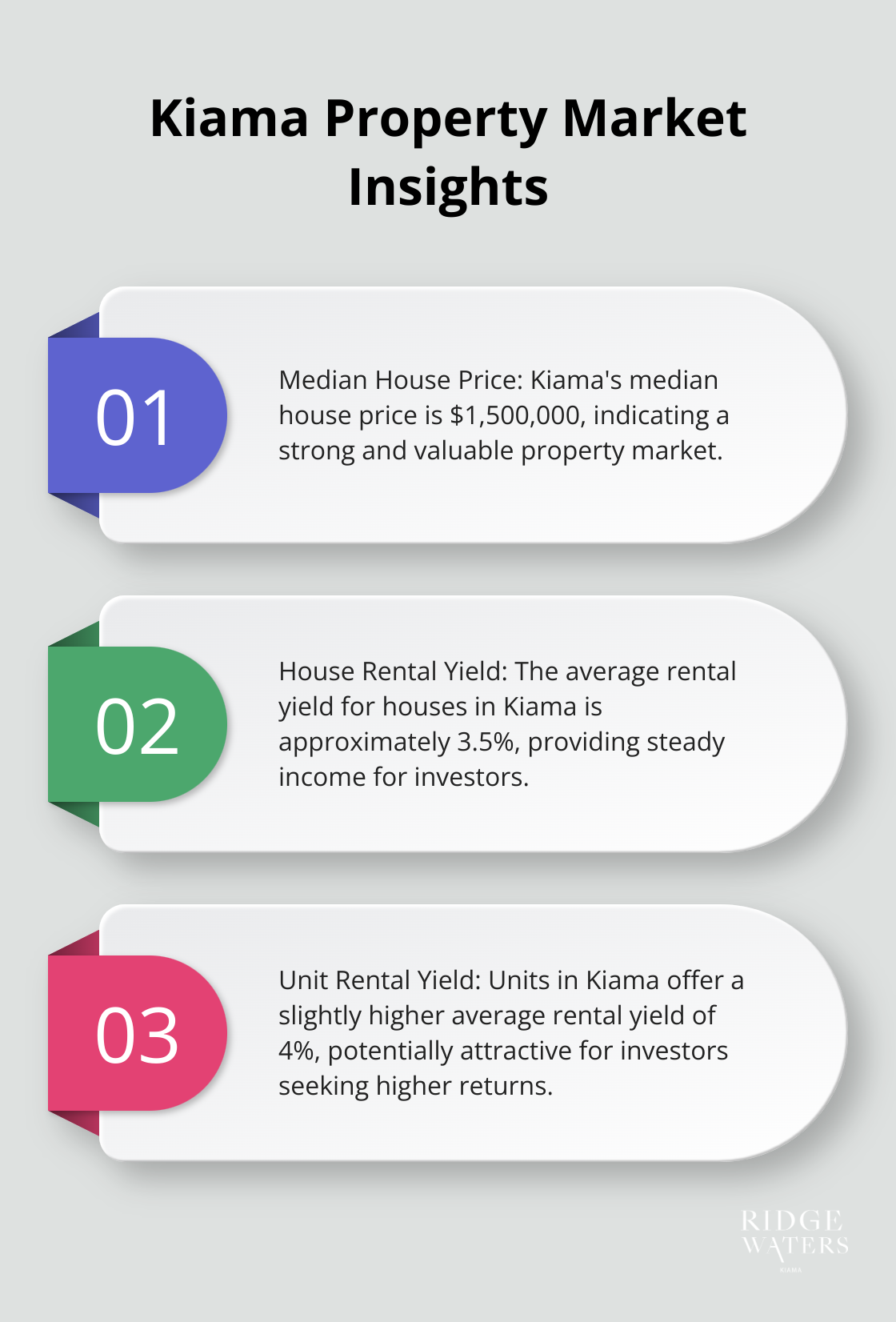

Kiama’s property market offers diverse investment options. Focus on areas with high rental demand and growth potential. The median house price in Kiama is $1,500,000, indicating strong market performance. Look for properties near Kiama’s popular beaches, the town centre, or with easy access to the train station for commuters to Wollongong or Sydney.

Calculate Potential Returns and Risks

Analyse potential returns and risks thoroughly. Consider factors like rental yield, which in Kiama averages around 3.5% for houses and 4% for units (according to Domain’s latest report). Factor in costs such as property management fees (typically 5-8% of rental income), council rates, and maintenance. Try to build a financial buffer that can cover at least three months of mortgage repayments without rental income to account for potential vacancy periods.

Secure Pre-Approval for Financing

Obtain pre-approval for financing before you start house hunting. This step gives you a clear budget and positions you as a serious buyer. Local mortgage brokers familiar with Kiama’s market can help you navigate this process. They can also advise on the best loan structure for your situation, whether it’s a line of credit against your existing property or a new investment loan.

Make a Competitive Offer

Kiama’s property market moves quickly. Act decisively once you’ve found a suitable investment property. Research recent sales of similar properties in the area to inform your offer. Consider engaging a buyer’s agent who knows Kiama’s market intricacies. They can help you negotiate effectively and potentially access off-market opportunities.

Prepare for potential competition when making an offer. Kiama’s desirable coastal location often attracts multiple bidders. Having your finances in order and the ability to move quickly can give you an edge in securing your chosen investment property.

Final Thoughts

Using equity to buy investment property in Kiama offers a powerful strategy to expand your real estate portfolio. This approach allows you to capitalise on Kiama’s thriving property market without substantial cash savings. You can potentially benefit from both rental income and capital appreciation, but success requires careful planning and thorough research.

Property investment carries risks such as market fluctuations, interest rate changes, and unexpected expenses. You should assess your financial situation, understand equity access methods, and evaluate potential risks and rewards. Maintaining a financial buffer and diversifying your investment portfolio will help mitigate these risks.

Ridgewaters Kiama presents an excellent opportunity to enter the market with its luxury apartments and versatile investment options. Its prime location and high-quality amenities make it attractive for investors and residents alike. You can harness the power of your home equity to create a robust property investment portfolio in Kiama’s vibrant real estate market.