Buying at Ridgewaters Kiama is more than picking a pretty kitchen or a view — it’s about the financing. The house is the easy part; the money is the part that breaks dreams. You need a financing strategy that actually matches your cashflow, your timeline, and what you want this property to do for you (home, weekend escape, rental income — each demands a different play).

Traditional mortgages, government-backed programs, investment loans — all on the table. Each can work…or not — depending on your credit, deposit, and appetite for risk. There’s no universal right answer; the right approach is the one that aligns with your specific circumstances and leaves you room to breathe.

This guide is the map — the key steps to secure financing, avoid the usual traps, and move from “I want” to “I own” with confidence. Read it, use it, and don’t let the paperwork be the thing that kills your coastal dream.

Know Your Real Spending Power

Calculate Your Deposit and Closing Costs

Start with the cash you actually have-not the fantasy number you scroll past on Zillow at 2 a.m. Lenders want a deposit-usually 10% to 20%-and then the closing costs bite off another 2% to 5% of the purchase price. Tuck an emergency reserve on top of that (because life is messy). If you’re shopping in the $1M to $2M band-where mid-luxury inventory in Deschutes County recently hit 190 listings-you’re staring at $100,000 to $400,000 to even cross the threshold. That’s not “moving day” money-that’s your ticket to the front door, before you own anything.

Understand Your Debt-to-Income Ratio

Income matters as much as cash. Lenders lean on your debt-to-income ratio-the slice of your gross monthly pay that goes to debt-to decide how big a loan they’ll underwrite. Conventional loans shoot for roughly 43% DTI (some lenders bend that if credit and reserves look pristine). If you pull in $10,000 a month and already pay $2,000 toward other debts (car, cards, student loans), you’ve got roughly $2,300 of wiggle room for a mortgage before you hit that limit. That $2,300-at current rates around 6%-buys you about $575,000 of borrowing power. Quick reality: the math compresses fast.

Boost Your Credit Score to Access Better Rates

Your credit score directly impacts the rates you’ll qualify for. Aim for 740+ if you want the lowest rates-because the gap between a 740 and a 680 will cost you tens of thousands over a 30-year loan. Check your FICO regularly (bank portal, free services-use them). Mistakes appear. Fixing errors takes time-and you do not want that clock running when you’re ready to put in an offer.

Existing Debt Reduces Your Borrowing Power

Don’t pretend monthly obligations don’t exist. That lease payment, car note, student balance, or credit-card minimum is real to lenders-and it subtracts directly from what they’ll lend you. Carry $500 a month in other payments? That’s $500 less for a mortgage payment every month. Tackle high-interest debt before you apply-small cuts to your DTI unlock surprisingly large gains in borrowing capacity.

Investment Properties Demand Different Financing Rules

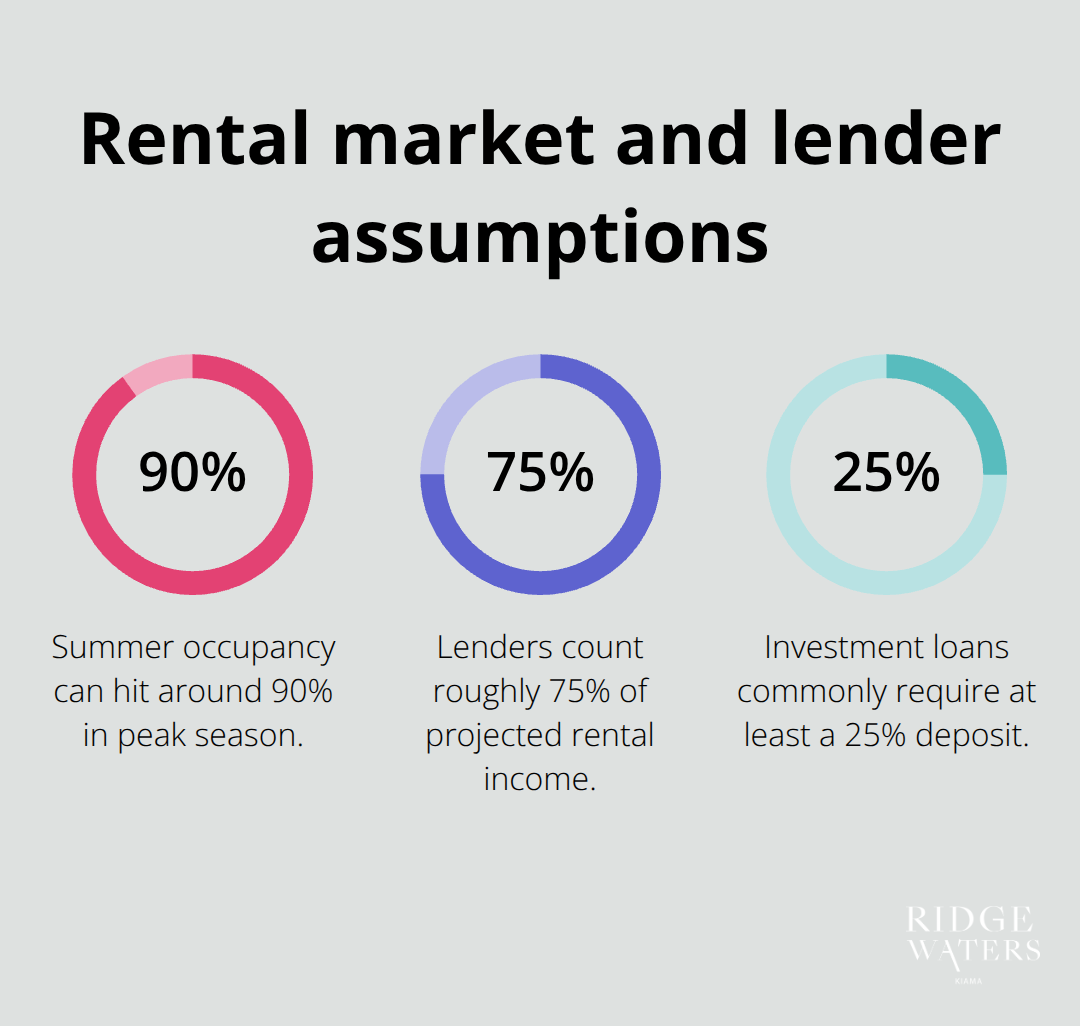

If you’re buying to rent-Airbnb or longer-term-expect the bank to treat this as a different animal. In markets where summer occupancy can hit 90%+ and ocean-view listings push about a 35% uplift in nightly rates, lenders still get conservative. Investment loans often require larger down payments (25%+), plus heavier reserves-think six months of mortgage payments parked in the bank after closing. Lenders also underwrite rental income at around 75% of projected receipts (not 100%)-they’re intentionally pessimistic about your cash flow. Bottom line: buying for rental income is a different financing path than buying to live in-different products, different documentation, different timeline-and it usually lowers your budget ceiling.

Your Financing Options at Ridgewaters Kiama

Conventional Mortgages and Rate Locks

Mortgage rates sitting around 6% are doing one thing-they’re reshaping buyer math. A tiny shift in rate can be the difference between a $575,000 house and a $625,000 house at the same monthly payment. Conventional fixed-rate mortgages dominate-15 or 30 years, you know your payment into 2056 (frightening and useful). The trade-off is obvious: conventional loans want 10%–20% down and a credit score near 740 for the best pricing. Score is 680? Expect a noticeably higher rate – and yes, that difference compounds for decades. Small percentage points today = big dollars later.

Government-Backed Programs and Trade-Offs

Government programs exist-FHA will let you in with as little as 3.5% down and lower credit standards. Sounds great – until you remember mortgage insurance premiums (MIP) that tack on monthly cost. VA and USDA loans are terrific for the people they serve, but in a coastal luxury market like Kiama they’re often not relevant. The real question isn’t which program sounds fancy; it’s which one gets you a roof without loading you with hidden fees that kill your cash flow.

Shopping Lenders and Comparing Terms

Don’t fixate on the headline rate-compare APRs. Closing costs run 2%–5% of the loan and vary wildly across lenders. A mortgage broker can pull multiple offers quickly (saving you time and often money) – but pick a good one. Lock a rate when it’s favourable – know the lock length and the cost to extend if your closing slips. These details are boring – and expensive if you ignore them.

Investment Financing for Rental Properties

Investment financing is a different animal – and where most buyers underestimate reality. Airbnb rentals at Ridgewaters Kiama can throw off real cash (summer occupancy routinely hits 90%+, ocean views command premium nightly rates). But lenders underwrite rental income at roughly 75% of your projected figure – so $50,000 expected? They’ll count $37,500. Expect larger down payments (25%+ is common) and the requirement to hold six months of mortgage payments in reserve after closing (sitting there, untouched).

Investment loans carry higher interest – typically 0.5%–1% more – because, well, lenders price in the risk. If you’re buying for short-term rental income, start with a lender who actually knows coastal vacation rentals. Generic brokers miss the nuances – and that costs you.

Next Steps: Documentation and Lender Selection

You’ve chosen a path-now hustle the paperwork and get specific lender offers in hand. Compare them line-by-line, lock the best terms, and move to make your offer with advantage (timing matters more than you think).

Steps to Secure Financing for Your Ridgewaters Kiama Purchase

Gather Documentation Before Pre-Approval

Pre-approval and pre-qualification are not the same thing-and lenders count on most buyers not knowing the difference. Pre-approval means a lender has eyeballed your finances and will give you a number; actual funding means they’ve ordered the appraisal, verified employment, and locked your rate. The gap between those two is where deals die – quietly, and at the worst possible time. Start collecting documentation now: credit score, proof of identity, proof of income and employment, and deposit and savings documentation. Self-employed buyers (or anyone with investment income) need profit-and-loss statements and rental history-lenders will ask for it anyway. Move first and you shave weeks off the timeline and stand out in Kiama’s expanding mid-luxury market.

Compare Lenders Using Loan Estimates

Shopping lenders is where most buyers leak money without realising it. Don’t call three banks and compare their headline rates-that’s theatre. Instead, demand Loan Estimates from at least four lenders (federal law forces them to give you one within three business days) and compare APR, not the pretty number up front. APR folds in closing costs and fees – which means a 5.8% offer with $8,000 in closing costs is not the same as 6.1% with $3,500. Do the math on total out-of-pocket over 15 or 30 years. For investment properties – where occupancy and nightly-rate assumptions matter – find a lender who understands coastal short-term rentals; the right underwriter will model realistic occupancy, not optimistic fairy tales. Pick your lender, lock the rate, then let the appraisal and inspection begin.

Understand Appraisal and Title Work Timelines

The appraisal is the lender’s safety net – they send someone to confirm the house is worth what you’re paying. Coastal appraisals can be conservative…so if it comes in under your offer, don’t combust, but do have a plan: renegotiate or bring extra cash. Title work runs alongside – a title search digs up liens, easements, or ownership knots that can stop a closing cold. Realistic timeline: appraisal 7–10 days, title another 5–7, underwriting 5–10. That’s typically 30–45 days from signed contract to closing – and yes, delays happen. Build a buffer.

Final Thoughts

Financing a Ridgewaters Kiama property changes the minute you decide what you want it to do – live there, or have it pay the mortgage. Owner-occupants stick with conventional mortgages; investors chasing rent need investment loans that want 25%+ down, six months of reserves, and underwriters who assume 75% occupancy (not the rosy 90%+ summer peaks you’re dreaming of). The route you take blows out your budget ceiling and monthly cash flow – big difference. Know your true borrowing power: tally deposit, closing costs, DTI (that’s debt-to-income) – then when rates flirt with 6%, lock one in and shop at least four lenders hard to compare APRs and closing fees.

Kiama moves fast – inventory ticks up, rates pull new buyers in, and homes trade with price trims averaging 9–13% off the original list (tier-dependent). Appraisals and title work chew up 30–45 days, so plan the timeline and get paperwork in order early – pre-approval turns from advantage to bottleneck when you dawdle. When the right place appears, move decisively… hesitating costs money in this market.

Explore Ridgewaters Kiama to see what’s available and start your financing conversation now, not after you’ve fallen in love with a view. Get pre-approved, lock your rate, and move with confidence into ownership.