At Ridgewaters Kiama, we often get questions about how to buy property with super. It’s a topic that intrigues many Australians looking to diversify their retirement savings.

Investing in property through your superannuation can be a powerful strategy, but it’s not without its complexities. This guide will walk you through the essentials of using your Self-Managed Super Fund (SMSF) to purchase property, helping you make informed decisions about your financial future.

What Is a Self-Managed Super Fund?

Self-Managed Super Funds (SMSFs) give you direct control over your investment decisions. This type of fund has become a popular choice for Australians who want to take control of their retirement savings. This trend has also reached Kiama, where many residents are exploring SMSFs as a way to invest in the local property market.

Definition and Structure

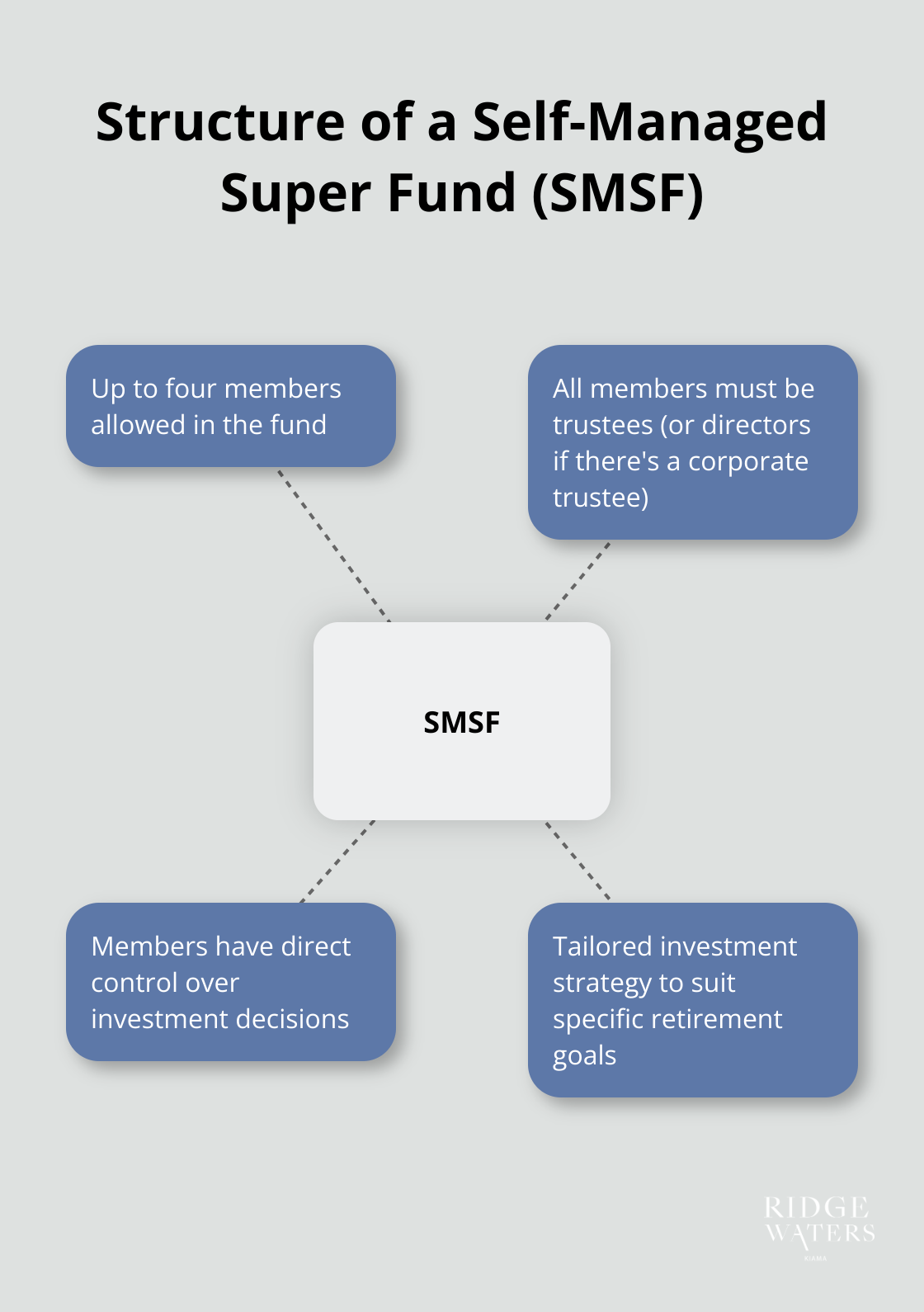

An SMSF is a private superannuation fund that you manage yourself. Unlike traditional super funds, SMSFs allow you to tailor your investment strategy to suit your specific retirement goals.

SMSFs can have up to four members, all of whom must be trustees (or directors if there’s a corporate trustee). This structure allows families or business partners to pool their super and invest together, which can be particularly advantageous in Kiama’s competitive property market.

Investment Options

One of the main attractions of SMSFs is the ability to invest in direct property. This is particularly relevant for those interested in Kiama’s property market, known for its stunning coastal views and strong rental demand.

Benefits and Responsibilities

Setting up an SMSF comes with significant benefits, but also substantial responsibilities. On the plus side, you have greater control over your investments and potentially lower fees compared to retail super funds.

However, running an SMSF requires time, expertise, and a commitment to ongoing education. You’ll need to stay updated on superannuation laws, investment trends, and tax regulations.

Legal and Compliance Obligations

SMSFs are heavily regulated by the ATO. You must comply with the sole purpose test, which states that the fund must be maintained for the sole purpose of providing retirement benefits to members.

Annual audits are mandatory, and there are strict rules about related party transactions. For example, if you’re considering buying a Kiama apartment through your SMSF, you can’t use it as a holiday home or rent it to family members.

Costs and Considerations

While SMSFs can be cost-effective for larger balances, they may not be suitable for everyone. This is particularly important when considering property investments in Kiama, which often require substantial capital.

Now that we’ve covered the basics of SMSFs, let’s explore how you can use your SMSF to invest in property, particularly in the attractive Kiama market.

How to Invest in Property Through Your SMSF

Eligible Property Types for SMSF Investment

Self-Managed Super Funds (SMSFs) offer various property investment options in Kiama. Residential properties, such as apartments, provide steady rental income and potential capital growth. Commercial properties (office spaces or retail shops) often offer longer lease terms and higher yields. Vacant land is also an option, but strict rules apply to its development.

Key Rules and Restrictions

The Australian Taxation Office (ATO) sets strict guidelines for SMSF property investments. The ‘sole purpose test’ requires the property to benefit fund members in retirement exclusively. You can’t use it as a holiday home or rent it to family members.

If you purchase a property in Kiama through your SMSF, neither you nor any related parties can live in or use the property (even if you pay market rent). The property must be managed at arm’s length, like any other SMSF investment.

Borrowing to purchase property through your SMSF is possible via a limited recourse borrowing arrangement (LRBA). This structure protects other SMSF assets if the loan defaults. Any recourse under the LRBA against the SMSF trustee is limited to rights relating to the asset. However, LRBAs have complex rules and typically higher interest rates than standard mortgages.

Benefits of SMSF Property Investment

SMSF property investment in Kiama’s thriving market can offer significant advantages:

- Potential strong capital growth

- Rental income taxed at the concessional super rate of 15% (which can be more favourable than personal tax rates)

- Direct control over your investment decisions

Challenges to Consider

While SMSF property investment has benefits, it also presents challenges:

Due Diligence in Kiama’s Market

To make informed decisions about SMSF property investment in Kiama, you should:

- Research local market trends

- Analyse rental yields and growth projections

- Consult local real estate experts who understand Kiama’s market nuances

The decision to invest in property through your SMSF requires careful consideration of these factors. In the next section, we’ll outline the steps to purchase property with your superannuation, helping you navigate this complex but potentially rewarding process.

How to Purchase Property with Your SMSF in Kiama

Establish Your SMSF

The first step involves the setup of your Self-Managed Super Fund (SMSF). This process includes the creation of a trust deed, appointment of trustees, and registration with the Australian Taxation Office (ATO). Local accountants and financial advisors in Kiama can assist you through this process, ensuring you comply with all legal requirements.

After establishment, open a separate bank account for your SMSF and transfer existing super funds. This process typically takes 3-4 weeks, so plan accordingly if you have your eye on a specific property in Kiama’s competitive market.

Create Your Investment Strategy

A robust investment strategy forms the backbone of your SMSF. This document should outline your fund’s investment objectives, risk tolerance, and asset allocation. For Kiama property investments, factor in the area’s historical capital growth and rental yields.

Your strategy should address liquidity needs, which is particularly important in Kiama’s seasonal rental market. Try to maintain sufficient cash reserves for property maintenance and potential vacancy periods during off-peak seasons.

Find and Purchase the Right Property

When you search for property in Kiama, focus on areas with strong growth potential. The northern suburbs, close to Kiama’s famous blowhole, have shown consistent appreciation. Properties near Surf Beach offer excellent rental prospects due to their popularity with tourists.

Before you make an offer, conduct thorough due diligence. This includes property inspections, review of strata reports (if applicable), and obtaining independent valuations. In Kiama’s unique market, local knowledge proves invaluable.

When you structure the purchase, remember that your SMSF must have sufficient funds to cover the deposit (typically 30-40% for SMSF loans) plus additional costs like stamp duty and legal fees. If borrowing becomes necessary, set up a limited recourse borrowing arrangement (LRBA) through a separate trust.

Manage Your SMSF Property

Effective management becomes key once you’ve acquired the property. For Kiama properties, consider a partnership with a local property manager who understands the area’s rental market dynamics (including the surge in demand during summer months and events like the Kiama Jazz and Blues Festival).

Ensure all rental income goes directly into your SMSF’s bank account and that all expenses are paid from this account. Keep meticulous records of all transactions, as your SMSF will need an annual audit.

Regular property maintenance is essential, especially given Kiama’s coastal environment. Budget for tasks like repainting exteriors every 5-7 years to protect against salt air corrosion.

Stay informed about changes in superannuation laws and local property regulations. The Kiama Municipal Council periodically updates zoning and development policies, which could impact your property’s value or usage potential.

Final Thoughts

Investing in property through your SMSF can build wealth and secure your retirement future. The process of how to buy property with super requires careful planning, thorough research, and a deep understanding of both superannuation and local property markets. Professional advice from financial advisors, accountants, and legal experts who specialise in SMSF and property investment is essential to navigate the regulatory landscape and optimise your investment strategy.

Every investment decision should align with your overall retirement goals and risk tolerance. What works for one investor may not suit another. Take time to assess your financial situation and long-term objectives before deciding if SMSF property investment is right for you.

Ridgewaters Kiama offers luxury apartments that combine contemporary living with investment potential. Our properties cater to various needs (from permanent residences to short-term rentals), providing flexibility in how you choose to utilise your investment. Buying property with your superannuation can enhance your retirement savings while investing in Kiama’s thriving property market.