Australia’s property market offers a wealth of opportunities for savvy investors. From bustling cities to picturesque coastal towns, there are numerous good places to buy investment property across the country.

At Ridgewaters Kiama, we’ve compiled a comprehensive guide to help you navigate the Australian real estate landscape. Our analysis covers top cities, emerging regional areas, and key factors to consider when choosing your investment location.

Where Are Australia’s Top Investment Cities?

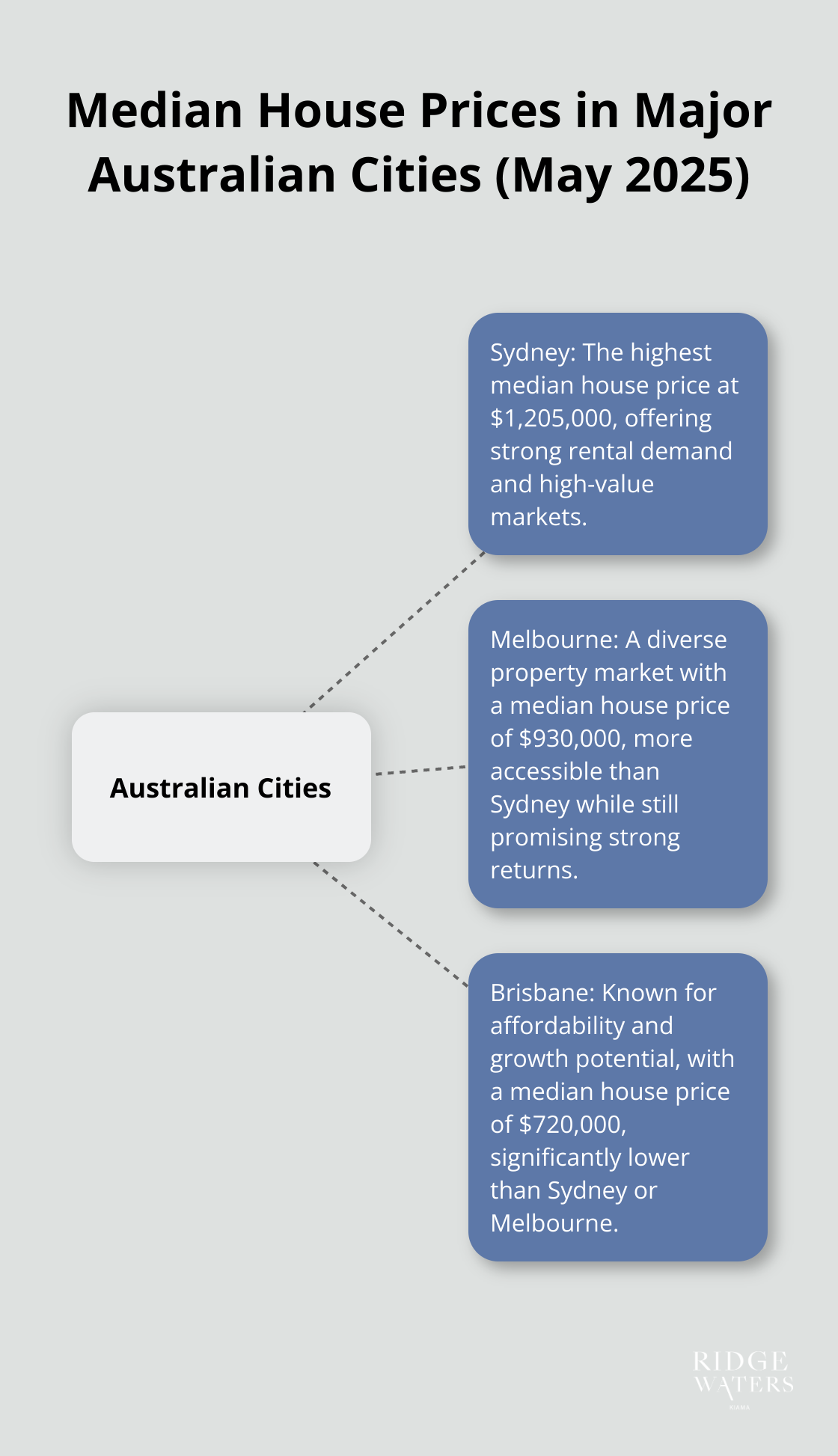

Australia’s property market presents a variety of opportunities for investors. Several cities stand out as prime locations for real estate investment. We at Ridgewaters Kiama have analyzed market trends and compiled insights on the top Australian cities for property investment.

Sydney: The High-Value Powerhouse

Sydney remains a top choice for property investors, with strong rental demand and high-value markets. The median house price in Sydney stands at $1,205,000 as of May 2025 (CoreLogic data). While this represents a significant investment, the potential for capital growth is substantial.

Key areas to watch in Sydney include the Inner West and Eastern Suburbs, where rental yields average 3.5% to 4%. These areas benefit from proximity to the CBD, excellent public transport, and a wealth of amenities.

Melbourne: Cultural Diversity Meets Property Variety

Melbourne’s property market offers a diverse range of options for investors. The city’s median house price is $930,000, making it more accessible than Sydney while still promising strong returns.

Areas like Footscray (just 7 kilometers from the CBD) are rapidly gentrifying and represent promising investment opportunities. With its excellent transport links and emerging food scene, Footscray’s median house price has increased by 15% over the past year.

Brisbane: Affordability and Growth Potential

Brisbane stands out for its combination of affordability and growth potential. The median house price in Brisbane is $720,000, significantly lower than Sydney or Melbourne. This affordability, coupled with strong population growth, makes Brisbane an attractive option for investors.

Suburbs like Ripley (part of the Brisbane Metropolitan Western Growth Corridor) are expected to see significant value growth due to planned infrastructure investments over the next decade. The area is projected to support substantial population growth, potentially leading to increased rental demand and property values.

Perth: Mining Influence and Market Rebound

Perth’s property market experiences a rebound, largely influenced by the resurgence in the mining industry. The city currently has the highest population growth rate in Australia, making its suburbs particularly appealing for property investments.

Coastal suburbs like Alkimos, Eglinton, and Yanchep are forecasted to see significant value growth due to lifestyle appeal and planned infrastructure improvements. These areas offer a combination of affordability and potential for capital growth that’s hard to find in other capital cities.

Kiama: The Hidden Gem

While these cities offer promising investment opportunities, Kiama (where Ridgewaters Kiama is located) combines many of the benefits of these top investment cities. With its proximity to Sydney (just 90 minutes south), coastal lifestyle, and growing popularity as a tourist destination, Kiama presents a unique investment proposition.

Kiama’s property market benefits from its natural attractions, essential amenities, and versatile investment options. The area caters to retirees, young families, investors, and holidaymakers seeking a laid-back coastal retreat. Properties in Kiama, like those offered by Ridgewaters Kiama, provide opportunities for both permanent residence and short-term rentals (including Airbnb), making them attractive to a wide range of investors.

As we move on to explore regional areas with investment potential, it’s important to consider how these locations compare to established metropolitan markets and unique coastal gems like Kiama.

Where Are Australia’s Best Regional Investment Areas?

Australia’s property market extends beyond its major cities. Regional areas offer unique investment opportunities, often with lower entry prices and strong growth potential. Let’s explore some of the most promising regional investment areas in Australia.

The Gold Coast: Sun, Surf, and Solid Returns

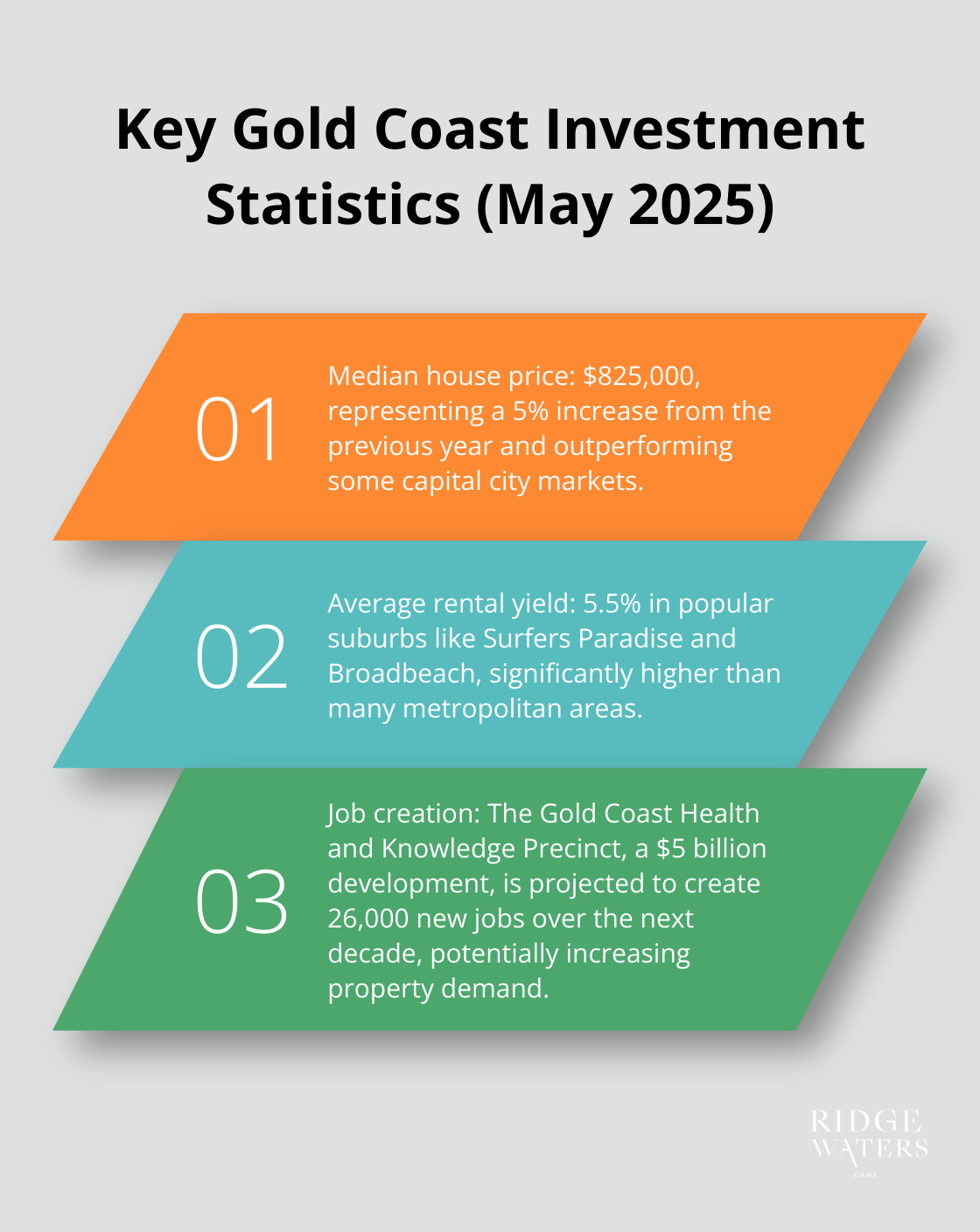

The Gold Coast attracts property investors with its tourism-driven economy and enviable lifestyle. As of May 2025, the median house price in the Gold Coast stands at $825,000 (CoreLogic data). This represents a 5% increase from the previous year, outperforming some capital city markets.

Surfers Paradise and Broadbeach appeal to investors targeting the short-term rental market. These suburbs boast average rental yields of 5.5%, significantly higher than many metropolitan areas.

The Gold Coast’s appeal transcends tourism. The city diversifies its economy, with rapid growth in the health and education sectors. The Gold Coast Health and Knowledge Precinct (a $5 billion development) will create 26,000 new jobs over the next decade, potentially increasing property demand in surrounding areas.

Newcastle: A City on the Rise

Newcastle, two hours north of Sydney, emerges as a hotspot for property investors. The city’s ongoing infrastructure development and strong university presence attract those priced out of the Sydney market.

The median house price in Newcastle is $780,000 as of May 2025, offering a more affordable entry point than Sydney while still promising strong growth potential. Wickham, in particular, has seen a 12% increase in median house prices over the past year, driven by its proximity to the new light rail and ongoing urban renewal projects.

Newcastle’s rental market thrives, with vacancy rates at a tight 1.2%. This has led to impressive rental yields, averaging 4.8% across the city.

Wollongong: Sydney’s Affordable Coastal Neighbor

Wollongong, 80 kilometres south of Sydney, offers investors a blend of coastal living and proximity to a major city. The median house price in Wollongong is $850,000, representing excellent value compared to Sydney’s prices.

The city’s economy diversifies beyond its traditional manufacturing base, with the University of Wollongong driving growth in the education and technology sectors. This economic shift attracts a younger demographic, creating strong rental demand, particularly in suburbs close to the university like North Wollongong and Fairy Meadow.

Wollongong’s property market has shown resilience in recent years. Even during the broader market downturn of 2023, Wollongong’s prices remained relatively stable, demonstrating the area’s underlying strength.

Kiama: The Hidden Gem of the South Coast

While these regional areas offer compelling investment opportunities, Kiama (home to Ridgewaters Kiama) combines many of their best features. Located just 90 minutes south of Sydney, Kiama presents a unique proposition for investors looking to capitalise on the best of regional Australia.

Kiama’s property market benefits from its natural attractions, essential amenities, and versatile investment options. The area caters to retirees, young families, investors, and holidaymakers seeking a laid-back coastal retreat. Properties in Kiama provide opportunities for both permanent residence and short-term rentals (including Airbnb), making them attractive to a wide range of investors.

With its coastal charm, proximity to Sydney, and growing popularity, Kiama stands out as a top choice for those seeking a balance between lifestyle and investment potential. As we move forward, it’s important to consider how these regional locations compare when evaluating the best places to invest in Australian property.

What Makes a Location Investment-Worthy in Kiama?

Population Growth and Economic Indicators

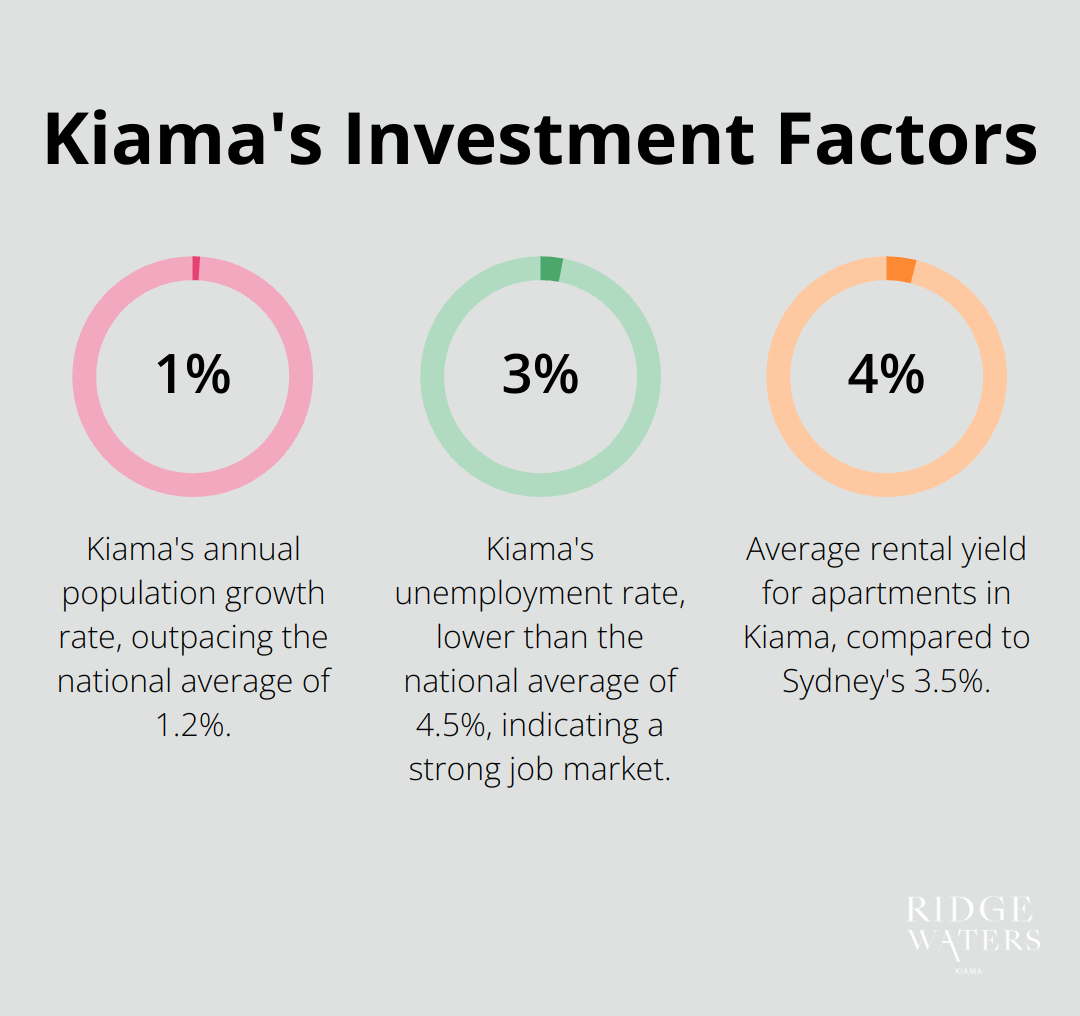

Population growth drives property demand. The Australian Bureau of Statistics reports that Kiama’s population has increased by 1.5% annually over the past five years (outpacing the national average of 1.2%). This trend supports a robust rental market and potential for capital appreciation in the area.

Economic indicators influence property investment success. Kiama’s diverse economy (supported by tourism, agriculture, and a growing professional services sector) provides a stable foundation for property investment. The unemployment rate in Kiama is 3.8%, lower than the national average of 4.5%. This low unemployment rate indicates a strong job market that attracts and retains residents.

Infrastructure and Urban Development in Kiama

Infrastructure projects boost property values. The ongoing $630 million Princes Highway upgrade improves connectivity to Sydney and Wollongong, which will likely increase property demand in Kiama. The Kiama Council has also committed $15 million to foreshore improvements, enhancing the area’s appeal to both residents and tourists.

Urban development initiatives impact investment potential. Kiama’s town centre revitalisation project (set to commence in 2026) will create more pedestrian-friendly spaces and attract new businesses. These developments will increase foot traffic and potentially boost rental yields for nearby properties.

Rental Yield and Capital Growth Prospects in Kiama

Rental yield is a key metric for property investors. In Kiama, the average rental yield for apartments is 4.2%, compared to Sydney’s 3.5%. This higher yield, combined with lower entry prices, makes Kiama an attractive option for investors who seek cash flow positive properties.

Capital growth prospects matter equally. Over the past decade, Kiama’s property market has shown steady growth, with median prices increasing by an average of 6.5% annually. This growth rate outperforms many capital city markets, which highlights Kiama’s potential for long-term capital appreciation.

Local Planning and Demographics

Local planning regulations and demographic shifts influence investment decisions. Kiama’s ageing population and increasing popularity among young families create diverse rental demand, from retiree-friendly units to family homes.

Upcoming developments also affect property values. The Kiama Council’s commitment to sustainable growth (as outlined in their Local Strategic Planning Statement) ensures that future developments will maintain the area’s character while meeting the needs of a growing population.

Natural Attractions and Lifestyle Appeal

Kiama’s natural beauty and lifestyle offerings contribute to its investment appeal. The famous Kiama Blowhole, pristine beaches, and scenic coastal walks attract tourists year-round, supporting a strong short-term rental market.

The area’s relaxed coastal lifestyle appeals to sea-changers and retirees, creating steady demand for permanent residences. This combination of tourist appeal and permanent resident demand creates a diverse and resilient property market in Kiama.

Final Thoughts

Australia’s property market offers diverse investment opportunities across major cities and regional areas. Sydney, Melbourne, Brisbane, Perth, Gold Coast, Newcastle, and Wollongong present compelling reasons for investment, each with unique advantages. These locations benefit from strong economic indicators, ongoing infrastructure developments, and attractive lifestyle factors.

When evaluating good places to buy investment property, investors must consider population growth, economic stability, and rental yield prospects. These elements significantly impact the long-term success of property investments. Kiama stands out as a hidden gem on the South Coast of New South Wales, offering a unique investment proposition with its natural beauty and strong economic foundations.

Ridgewaters Kiama offers luxury apartments that cater to a wide range of investors and residents. These properties provide options for both permanent residence and short-term rentals, allowing investors to tap into Kiama’s thriving tourism market. Thorough research and due diligence remain essential for making informed decisions that align with your financial objectives in Australia’s diverse property market.