At Ridgewaters Kiama, we often get questions about using your super to buy property. It’s a strategy that can potentially boost your retirement savings.

However, it’s not a decision to be taken lightly. This guide will walk you through the process, benefits, and risks of investing your superannuation in real estate.

What Is Superannuation and How Can It Buy Property?

The Basics of Superannuation

Superannuation, or ‘super’ as Australians call it, is our retirement savings system. It’s money set aside during your working years to support you in retirement. Employers must contribute 11% of an employee’s earnings to their super fund (set to increase to 12% by 2025). You can also make voluntary contributions to boost your retirement savings.

Using Super to Invest in Property

Investing your super in property can potentially provide stronger returns than traditional super investments. However, strict rules apply. You can’t use your super to buy a property to live in or holiday in. It must be purely for investment purposes.

Regulatory Framework for Super Property Investments

The Australian Prudential Regulation Authority (APRA) oversees the superannuation industry. If you want to use your super to invest in property, you’ll need to set up a Self-Managed Super Fund (SMSF).

SMSFs allow you direct control over your super investments, including property. However, they come with significant responsibilities. You must comply with the Superannuation Industry (Supervision) Act 1993, which includes strict rules about how SMSF assets can be used.

For example, if you’re considering a property as an investment, you can’t live in it or rent it to family members. The property must be managed at arm’s length and for the sole purpose of providing retirement benefits to fund members.

Understanding the Risks

It’s important to understand these regulations before making any decisions. Don’t put your retirement savings at risk due to a lack of understanding.

Using super to buy property isn’t a decision to take lightly. It requires careful consideration of various factors, including market conditions, compliance requirements, and your overall retirement strategy. In the next section, we’ll explore the specifics of Self-Managed Super Funds and how they relate to property investment.

How to Set Up an SMSF for Property Investment

Establishing Your SMSF

The creation of a Self-Managed Super Fund (SMSF) for property investment requires meticulous planning. The process starts with the selection of trustees, creation of a trust deed, and registration with the Australian Taxation Office (ATO). You must open a separate bank account for your SMSF and obtain an Australian Business Number (ABN).

SMSF Borrowing Arrangements

SMSFs can access funds for property purchases through a Limited Recourse Borrowing Arrangement (LRBA). This structure safeguards other SMSF assets in case of loan default. LRBAs come with strict regulations, such as the restriction to use the loan for a single acquirable asset (e.g., a residential or commercial property).

Selecting the Right Property

SMSF property investments face certain restrictions. You can purchase residential properties, commercial properties, or vacant land for development. However, you cannot buy a property from a related party or use it as your personal residence.

Kiama’s property market offers attractive options for SMSF investors. The area’s popularity as a tourist destination contributes to strong rental yields.

Compliance and Management

After property acquisition, you must ensure its management complies with superannuation laws. This includes the collection of market-rate rent, property maintenance, and detailed record-keeping of all transactions. Many SMSF trustees opt to hire professional property managers to handle these responsibilities.

Tax Considerations

SMSFs benefit from concessional tax treatment. Investment property income faces a 15% tax rate during the accumulation phase. In the pension phase, you might not pay any tax on the income. However, professional advice remains essential to fully grasp the tax implications of your investment.

The setup of an SMSF for property investment presents both opportunities and challenges. While it offers potential benefits, it also comes with significant risks and responsibilities. Professional guidance from financial advisors specialising in SMSF property investments can help you navigate these complexities and align your investment with your retirement goals. In the next section, we’ll explore key considerations when using your super to buy property, including potential risks and limitations.

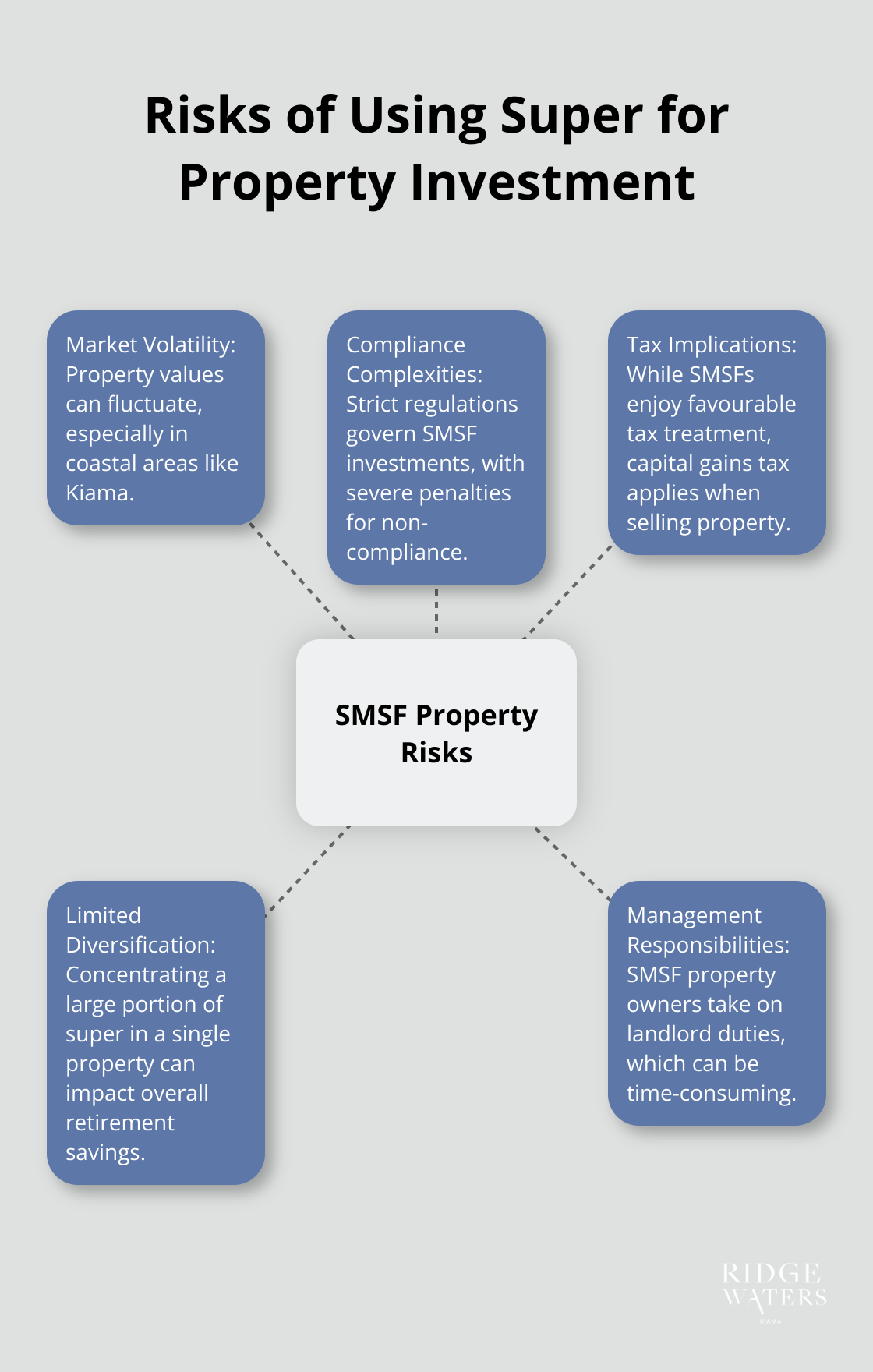

What Are the Risks of Using Super for Property?

While using your superannuation to invest in property can be an attractive option, it’s crucial to understand the associated risks. Let’s explore the main challenges you might face:

Market Volatility and Liquidity Concerns

Property markets can fluctuate, especially in coastal areas like Kiama. While the region has experienced steady growth (median house prices increased by 7.2% in the past year according to CoreLogic), past performance doesn’t guarantee future results. The illiquid nature of property investments means you can’t sell quickly if you need funds, which could leave you vulnerable during market downturns.

Compliance Complexities

Managing an SMSF for property investment requires navigation through a maze of regulations. You are restricted from having in-house assets that comprise more than 5% of the market value of the SMSF’s total assets. Penalties for non-compliance can be severe.

Tax Implications

SMSFs enjoy favourable tax treatment, with rental income taxed at just 15% during the accumulation phase. However, capital gains tax (CGT) applies when you sell the property, even if you’re in pension phase.

Impact on Retirement Savings

Concentrating a large portion of your super in a single property can limit diversification. This difference can significantly impact your retirement nest egg over time.

Management Responsibilities

Owning an investment property through your SMSF means you take on landlord duties. In Kiama, where short-term rentals are popular, this can involve frequent tenant turnover and maintenance.

Final Thoughts

Using your super to buy property can build wealth for retirement, but it comes with challenges. The potential for strong returns and tax benefits must be weighed against market volatility risks, compliance complexities, and the impact on your overall retirement savings. Professional advice from financial advisors, accountants, and legal experts who specialise in SMSF property investments will help you navigate regulations and understand tax implications.

A balanced approach to property investment within your superannuation is essential. Property can add value to your investment portfolio, but it shouldn’t compromise diversification. Consider how a property investment fits into your broader retirement strategy, taking into account your risk tolerance, time horizon, and other financial objectives.

For a property investment opportunity that combines luxury living with potential returns, explore Ridgewaters Kiama. Our apartments offer a premium coastal lifestyle and versatile investment options (including short-term rentals). Ridgewaters Kiama provides a unique blend of comfort and investment potential in one of Australia’s most sought-after coastal locations.